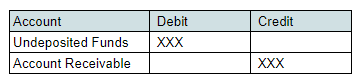

- Customer payments are the amounts received from customers in exchange for goods or services sold. To record the payments received that are not yet deposited to the bank, GL impact will show an increase in undeposited funds and a decrease in assets (account receivable).

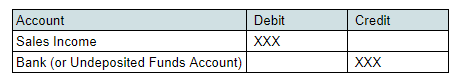

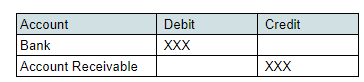

Here’s how to record payments that are deposited directly into the bank.

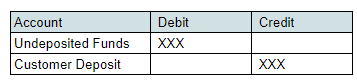

2. Customer deposits occur when the customer pays for goods or services in advance. To record customer deposits, GL impact will show an increase in both undeposited funds and customer deposits.

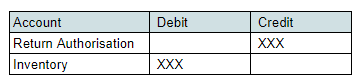

3. Return authorizations are non-posting transactions and are entered when a customer wants to return an item. Items on return authorization have no accounting impact until the items have been received back in the inventory account.

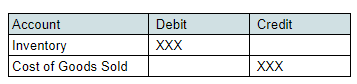

4. Return receipts are entered when the items on return authorizations have been received. The items will be placed back in the inventory account, resulting in an increase in assets and a decrease in the cost of goods sold.

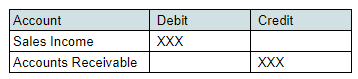

5. Credit memos are issued to the customer when an order has been returned or not fulfilled. This will reduce the amount payable by the customer, which will also result in a reduction in the amount expected to be received.

6. Customer refunds are when a business returns the payment to the customer. The GL impact will show a decrease in both income and funds.