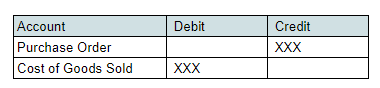

- Purchase orders are non-posting transactions that are sent to a vendor to keep track of items that are expected to be delivered. They include the associated price and quantity.

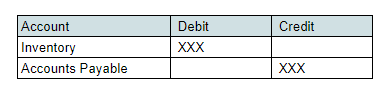

2. Item receipts are used to match against an open purchase order when items have been received. The GL impact will show an increase in the asset account and an increase in the accounts payable account.

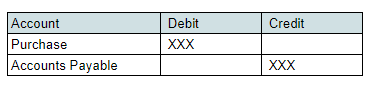

3. Vendor bills are invoices received from vendors that are payable when due; they help businesses determine the total amount they owe. GL Impact will show an increase in the payables account and an increase in the purchases.

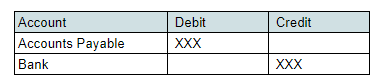

4. Vendor Payments are created when the vendor bill has been paid. This transaction will reduce both the accounts payable account and funds (cash in the bank).

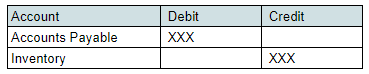

5. Vendor Credits are entered when an item is returned to the vendor. The vendor usually issues a credit memo that will reduce both the amounts payable and the inventory or asset account.