I was able to test in a test account, where I generated depreciation journal entries (based on usage)!

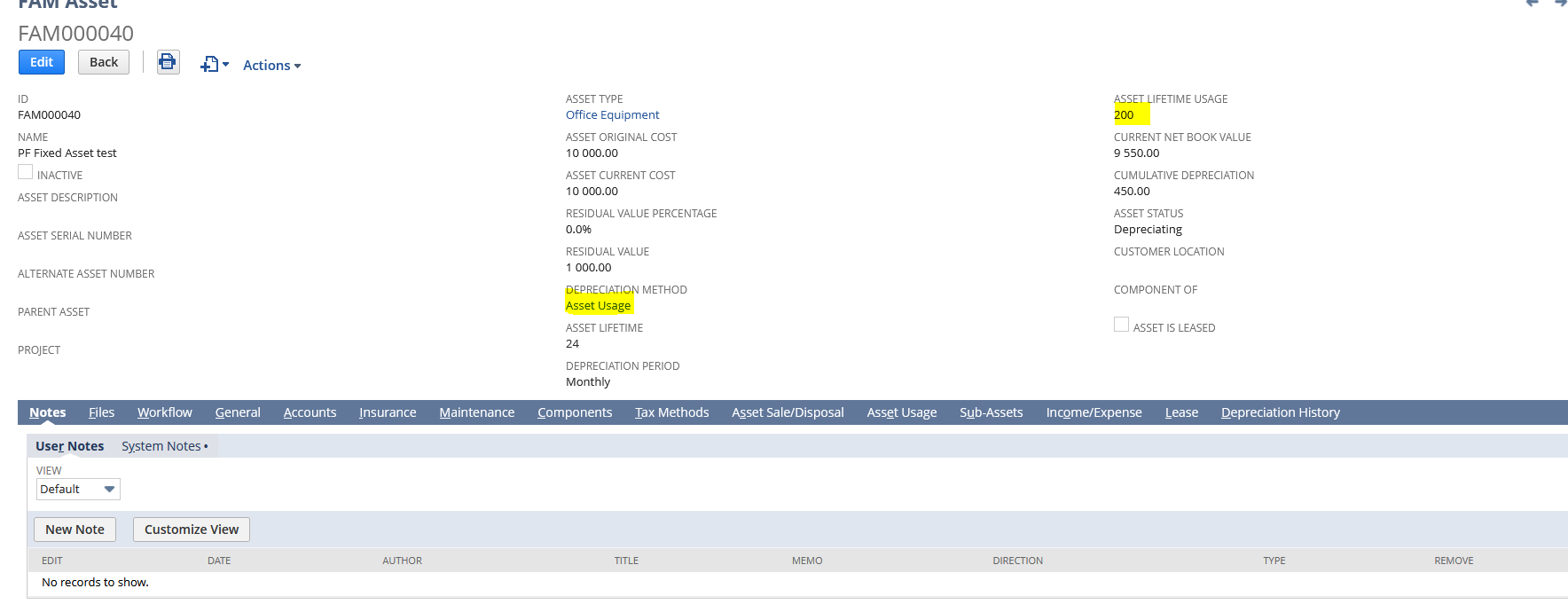

I have initially created an asset with a depreciation method of Asset Usage

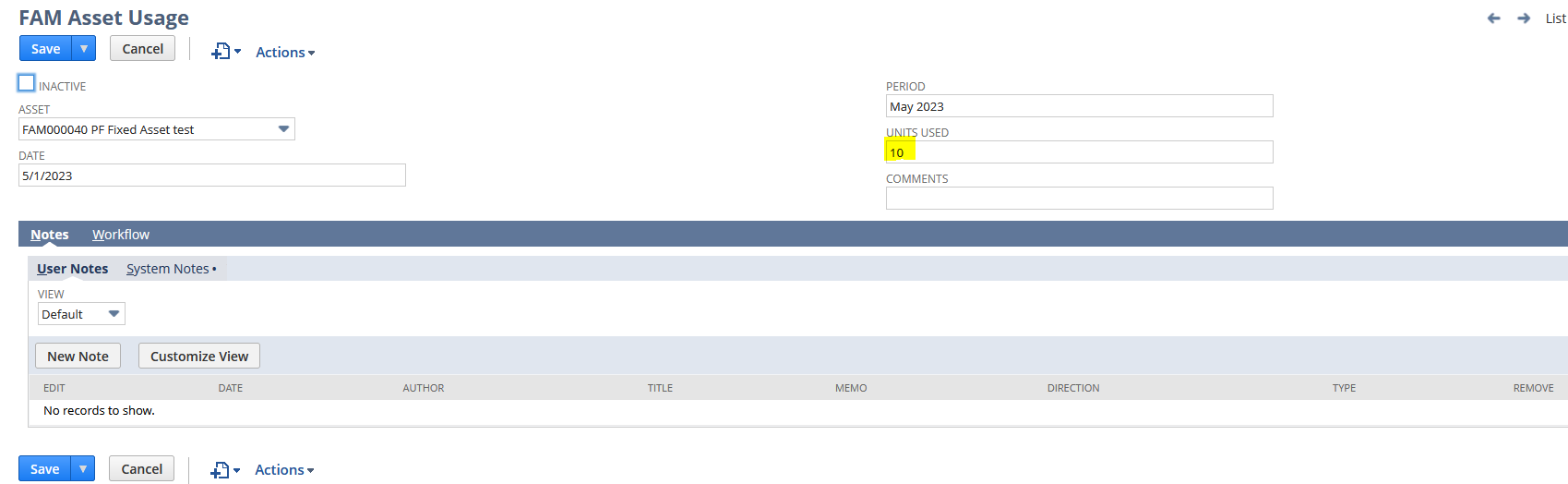

I then created an Asset Usage record, with 10 units used:

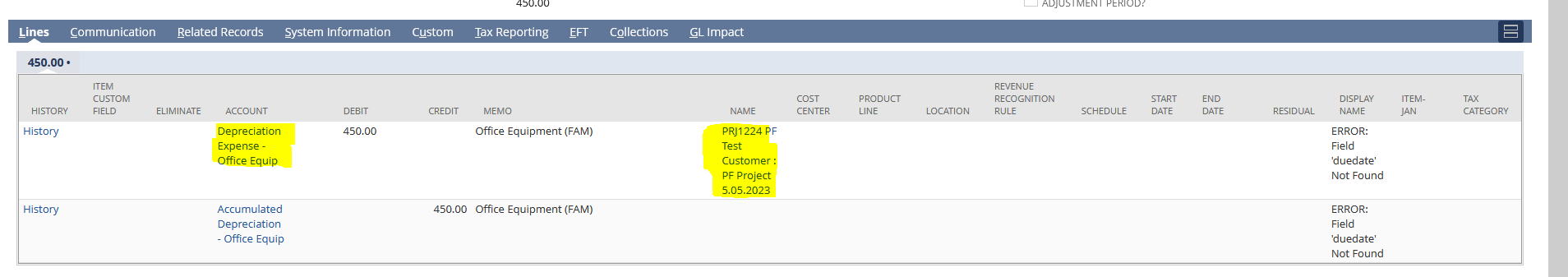

I then went to Fixed Assets > Transactions > Asset Depreciation. It then created a Depreciation Journal Entry.

I edited the Depreciation Journal Entry and added the project name in the Depreciation Expense line:

As per SuiteAnswers Id: 61923 Setting up Asset Usage Depreciation Method

The asset depreciation is based on the following formula: (Total cost – Salvage value) /Asset Life Time Usage * Units entered in Units Used column of the Asset Usage sub tab.

So in this scenario (10,000-1,000) = 9,000/200 = 45 * 10

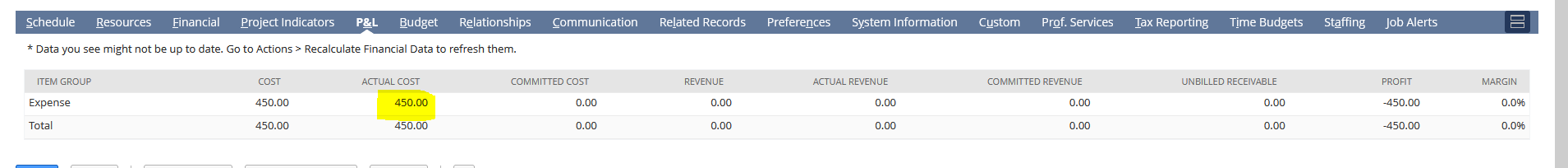

I updated the Project record via Recalculate Financial Plan/Project Plan:

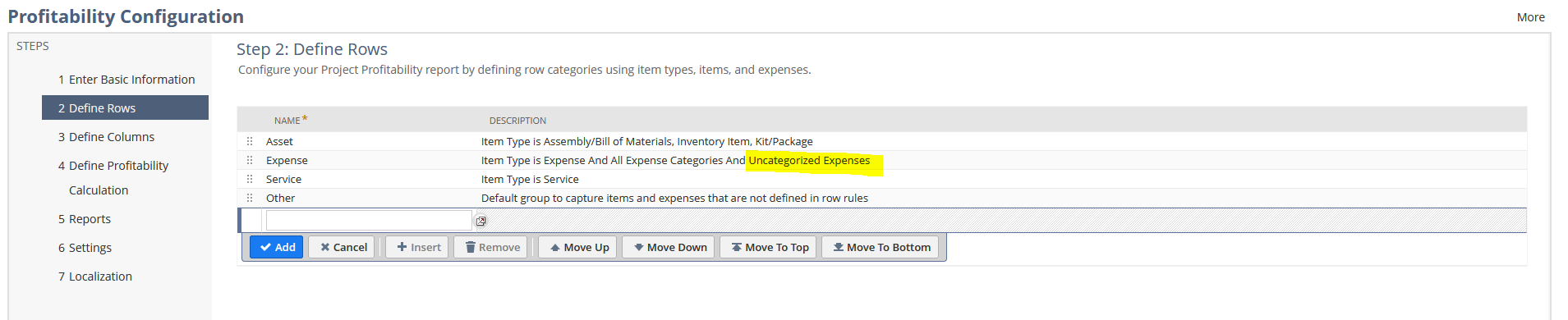

The cost was reflected in the Actual Cost. This is because when checking the Project Profitability set up it is an uncategorized expense

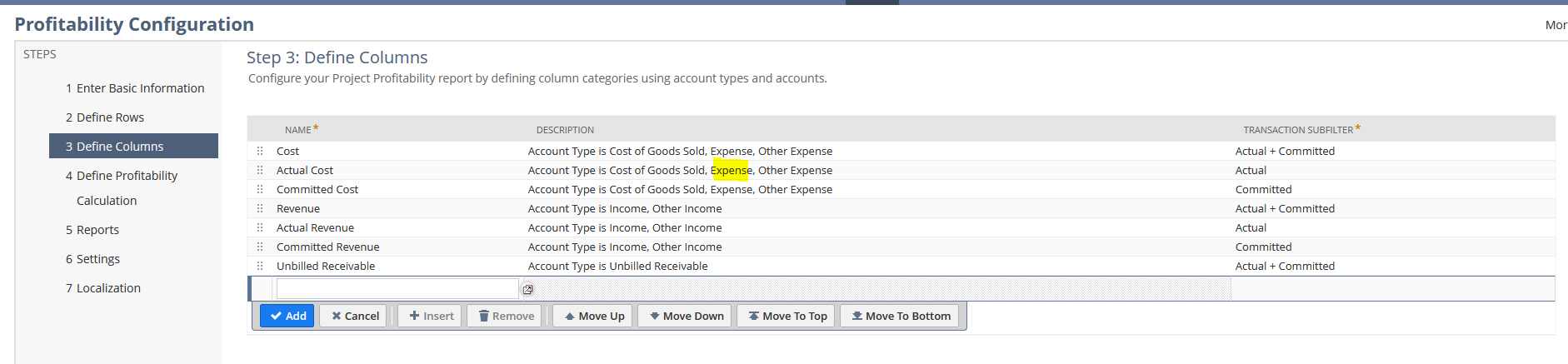

and the account type is an expense

You can also check these SuiteAnswers:

100693 | Asset Usage Method shows No Depreciation History

70164 | Advanced Project Profitability