Process Walkthrough

Start by creating a Purchase Order. Select your items, quantities and save the Purchase Order. If there is any approval process associated to your Purchase Orders, ensure that the transaction is approved.

From the Purchase Order, receive the order to create an Item Receipt transaction.

On the Item Receipt, you can account for Landed Costs in 3 ways:

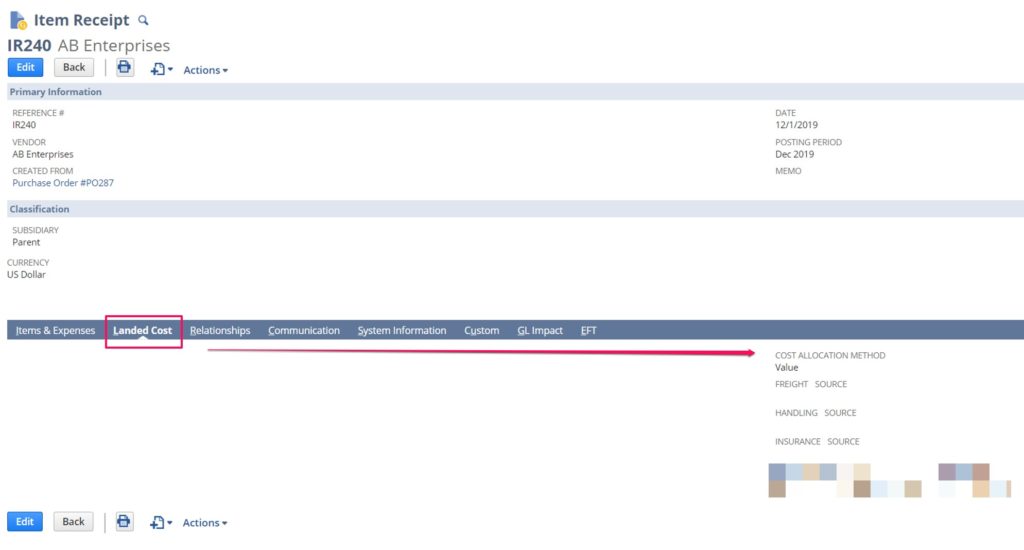

Option #1: Per Transaction – Landed Cost Subtab

Click on the Landed Cost subtab, and you will see a drop-down field allowing you to select which Cost Allocation method you would like to use. Additionally, you will see an amount field for each of your Landed Cost categories, as well as the source.

- Limitation: Using this subtab forces you to select one method of allocation across the entire Item Receipt.

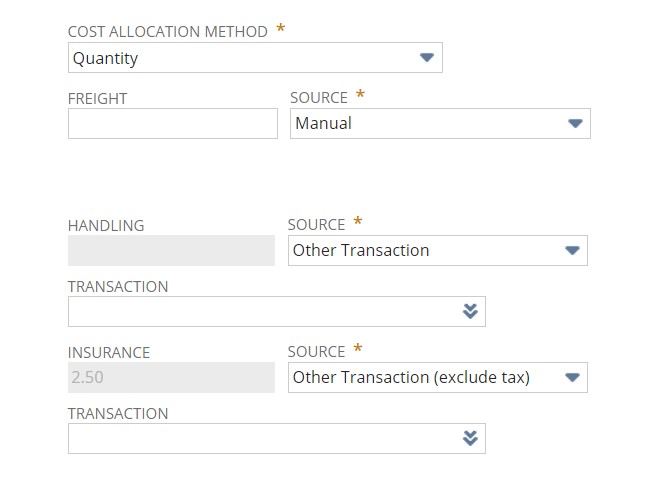

In Edit mode:

For each Landed Cost category, you have the amount, as well as the source. The source field gives you three options:

- Manual – This option allows you to manually set the currency value incurred for that specific category.

- Other Transaction – This option allows you to select the Vendor Bill that you create(d) for the landed costs (eg. From the shipping vendor).

- Other Transaction (Exclude Tax) – This option allows you to select the Vendor Bill that you create(d) for the landed costs (eg. From the shipping vendor), but uses the total value excluding taxes.

Note: For options 2 and 3 above, you must set up the Vendor Bill properly. See Enter Vendor Bill section below.

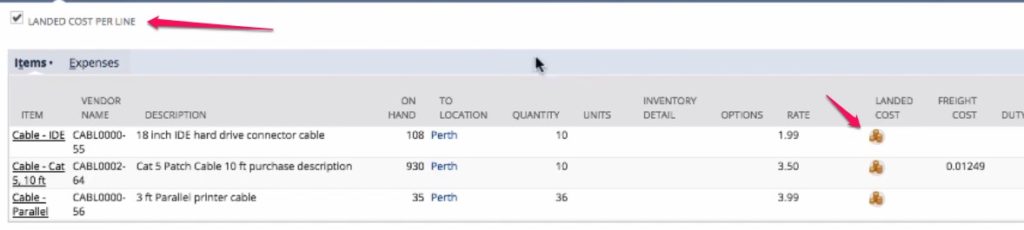

Option #2: Per Item – Manual Entry

On each of the lines on the Item Receipt, you’ll see a coins icon for Landed Costs. Click it to open the pop-up window that will allow you to select the currency amount incurred for each category for that specific line (item and quantity).

To use this, ensure the Landed Cost per Line box is checked on the main tab.

Option #3: Per Item – Estimated Landed Costs Entry

On each of the lines on the Item Receipt, you’ll see the default Landed Cost template (if you are using templates) set on the items. Check the Calculate Landed Costs box on the line and save the transaction. NetSuite will calculate the Estimated Landed Costs based on the template being used for each item.

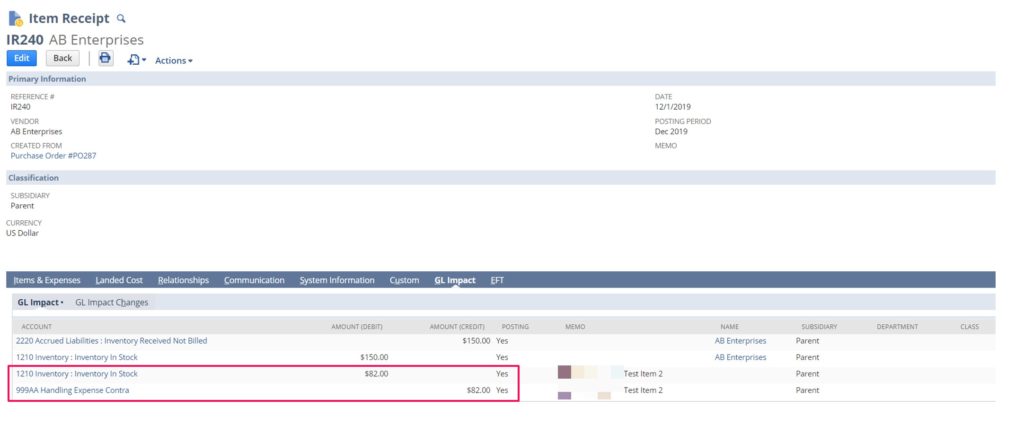

Irrespective of how Landed Costs are calculated, when you save the Item receipt and view the GL impacts, you’ll notice that the expense accounts selected on the Landed Cost categories are credited, while the Inventory Asset account(s) linked to the items are debited for the same amounts:

This credit is offset by the actual accrual of that expense when we enter the Vendor Bill.

Enter Vendor Bill

If you receive your Landed Cost bills at the same time that you receive items, you can enter accurate amounts on the Item Receipt and create a Vendor Bill for the matching amounts.

Assuming you receive the bill for your shipping and other Landed Cost related expenses after you’ve received the items, you’ll have to create a new vendor bill separate from the items.

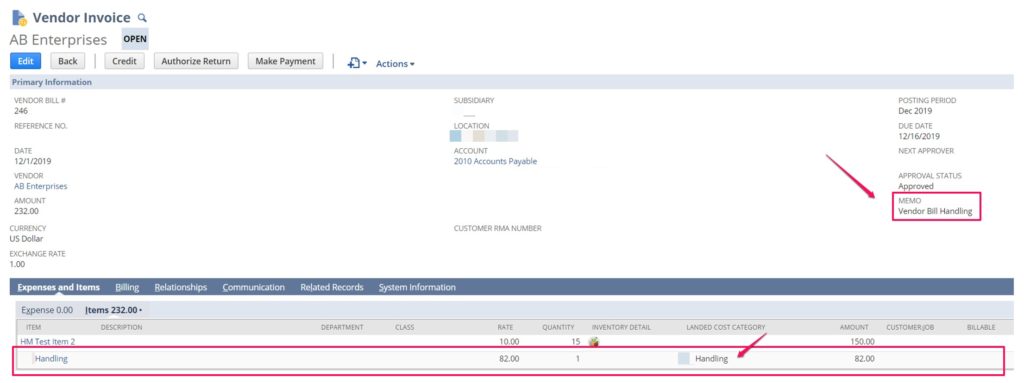

Create a new vendor bill, and under the items sublist, select the Other Charge Item(s) for the Landed Cost expenses incurred. Add a line for each category such as Freight, Handling etc. It is important to ensure that you select the matching Landed Cost category on that line as well.

Also ensure the Memo (header level) is populated in detail, as that is the field used to recognize this bill below if you need to select it on the Item Receipt. (Excited? Keep reading!)

Make the Connection Between Receipt and Expense

Once you’ve saved the vendor bill, you have two options:

- Update Item Receipt – You can go back to the original Item Receipt, and update the Landing Cost subtab, using the Other Transaction or Other Transaction Exclude Tax options. To use this option, select the Vendor Bill (recognized by the memo field) in the Other Transaction field and NetSuite will automatically update the currency amount to the line total for the matching Landed Cost category, overriding your original manual or estimated amounts.

If the items have already been fulfilled, their COGS will be updated as well on the Item Fulfillment records. If not, you will see the updated amount included in the COGS when you do fulfill the items.

Issues with this approach is that you can only attach one Vendor Bill to that one Item Receipt. (ie. If you have one bill for multiple receipts, you will need to break them down into multiple bills in NetSuite). Additionally, the entire applicable amount of the transaction is applied to the items, even if you receive less than the expected amount.

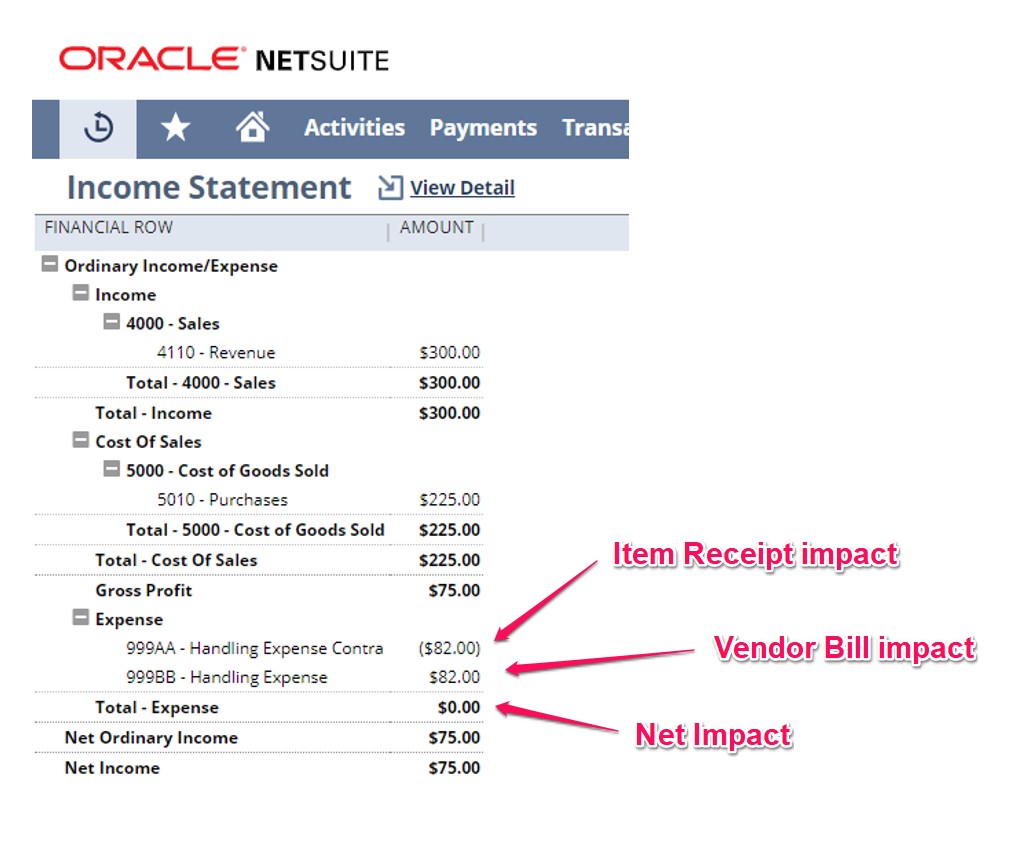

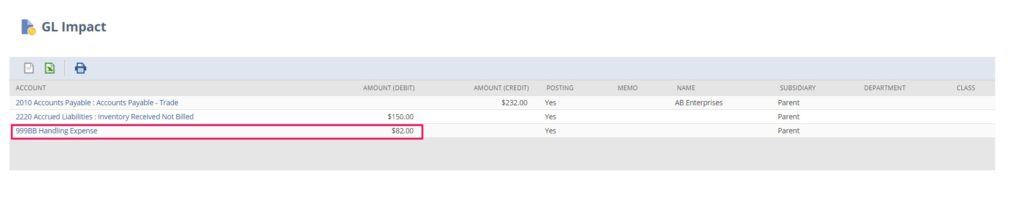

- Do nothing – If you don’t associate the Vendor Bill back to the Item Receipt, two things can happen. If the amount you entered on the Item Receipt matches the amount on the Vendor Bill, the Credit to the expense contra account (from the Item Receipt) and the debit to the expense itself (from the Vendor Bill) cancel each other out, leaving you with a net-zero impact.

If there is a difference between the Item Receipt and Vendor Bill amounts, then that variance will be shown under the expense section on the Income Statement.

Issue with this approach is that the COGS is not fully accurate. If you overestimated the Landing Costs, your COGS will be overstated, and vice versa. However, that over/underestimation is corrected by the variance on the Expense section, and this your Net Income is accurate. Your Gross Profit, however, is over/understated due to the inaccurate COGS.

See below an example where the amounts balance out, and therefore have no variance.