In today’s global economy, multinational corporations (MNCs) are experiencing remarkable growth and success. Collectively, these entities play an essential role in driving global production, international trade, and investments.

Multinational corporations conducting business on a global scale heavily depend on these foreign markets to facilitate currency exchange from various corners of the world. It helps businesses to trade and buy and sell their goods internationally.

Companies that regularly perform transactions in currencies different from their functional currency often face fluctuations in foreign exchange rates, resulting in potential gains or losses. Consequently, to accurately assess their financial position, these companies are obliged to perform a foreign currency revaluation. This process ensures that their financial statements reflect the current value of assets, liabilities, and transactions denominated in foreign currencies at the prevailing exchange rates.

In line with this, NetSuite has a Multiple Currencies feature which assists and allows users to create transactions with customers and vendors in currencies other than their company’s base currency and account for the fluctuations in exchange rates at the same time.

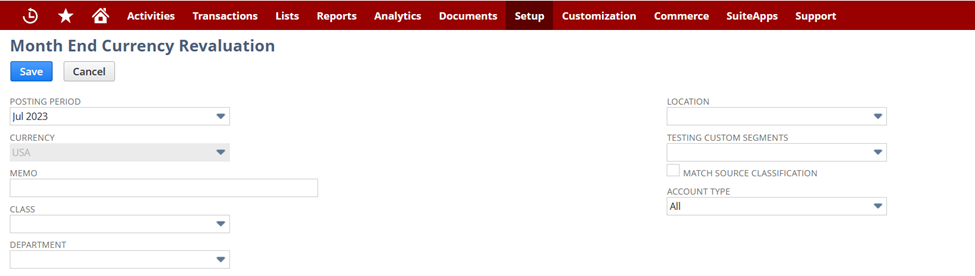

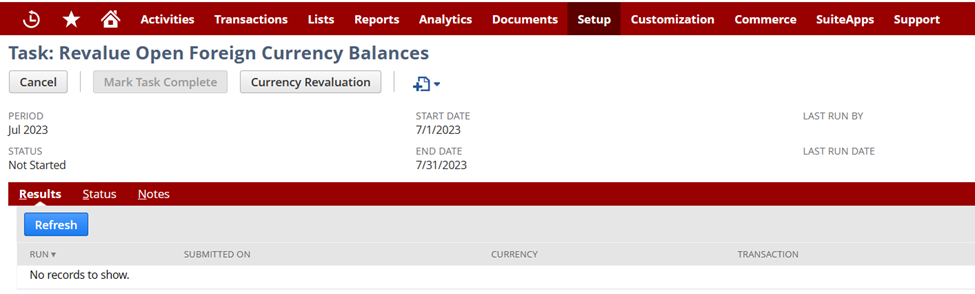

Revaluations can be generated by the users at any time via Transactions > Financial > Revalue Open Currency Balances or as part of the Period Close Checklist.

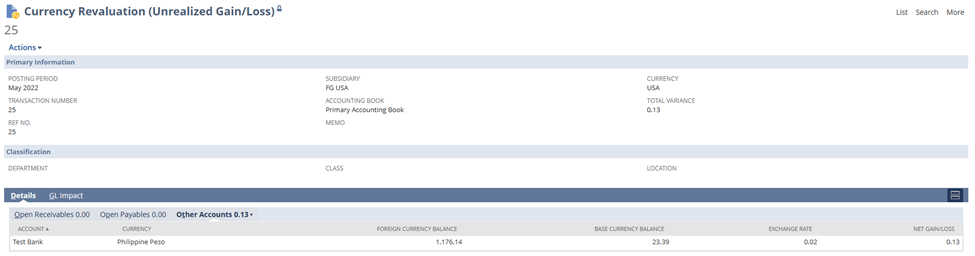

Currently, the ability to show the computation of currency revaluation for accounts other than Open Receivables and Open Payables is considered a system limitation.

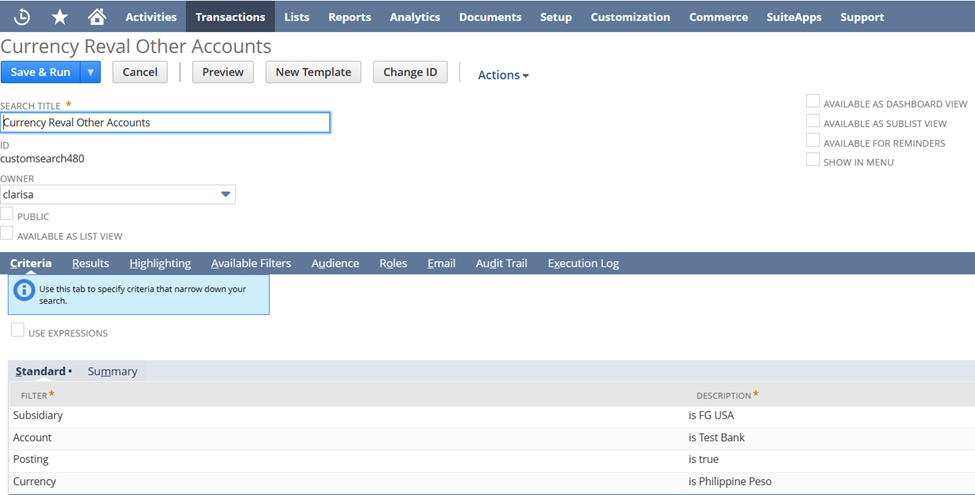

However, as a workaround, users can create a Saved Search to display the breakdown of the transactions involved under the Other Accounts tab:

1. Navigate to Lists > Search > Saved Searches > New

2. Select Transaction

3. Under Criteria tab > Standard subtab > Filter section, add the following:

- Subsidiary : input the Subsidiary

- Account : select the Account involved

- Posting : Yes

- Currency : input the Currency associated with the account under the Details tab of the Currency Revaluation record

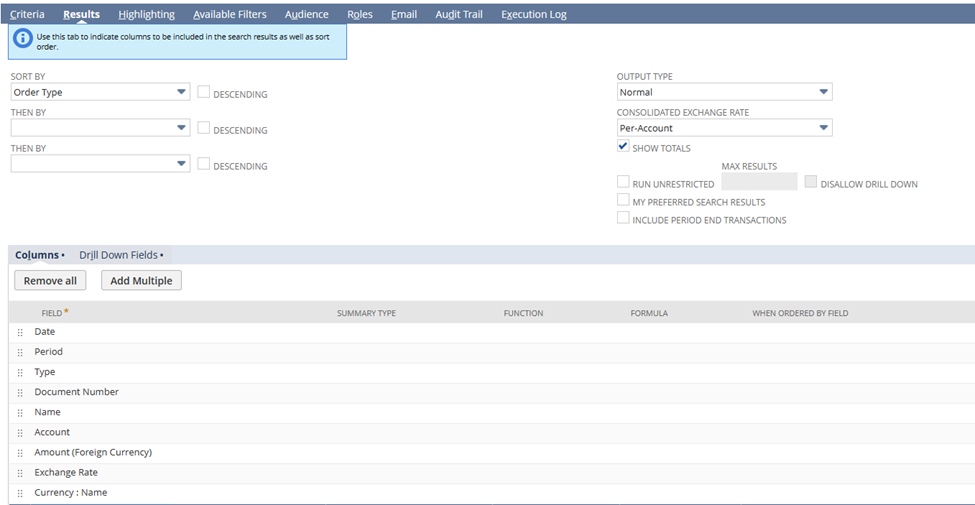

4. Under Results tab > Mark Show Totals

5. In Columns subtab > Click Remove All > in Field section, add the following:

- Date

- Period

- Type

- Document Number

- Name

- Account

- Amount (Foreign Currency)

- Exchange Rate

- Currency

6. Populate Search Title

7. Click Save & Run

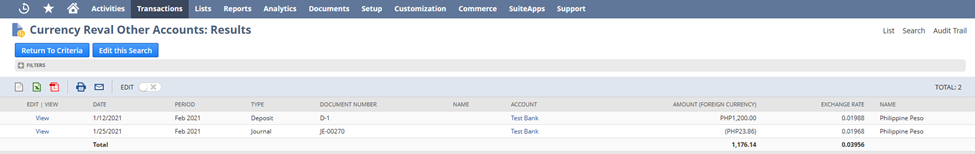

The result will now provide the breakdown of transactions that make up the amounts under the Other Accounts tab of the Currency Revaluation (Unrealized Gain/Loss) record. This will greatly help users in reconciling and verifying the foreign currency amounts and ensure that their financial statement balances are accurate.