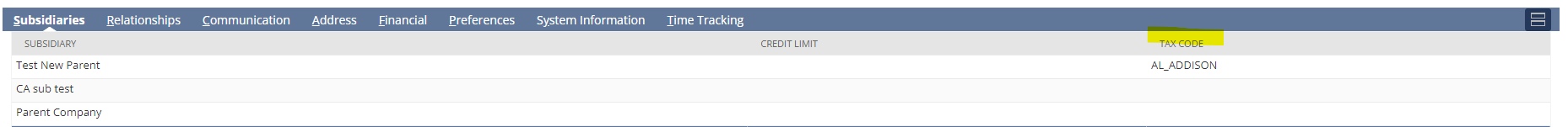

If you use NetSuite OneWorld and this vendor is shared with multiple subsidiaries, note the following. You specify the tax code at the line-level on the Subsidiaries subtab. Tax code is not available in the US edition for accounts that are not OneWorld.

You can select a tax code that is associated with any of the secondary subsidiaries assigned to this vendor.

The default tax code you assign to a subsidiary vendor combination must be available on purchase transactions. Otherwise, you cannot select this tax code on purchase orders or bills for that vendor. Ensure that the Available On field of the tax code record (Setup > Accounting > Tax Codes) is set to Purchase Transactions or Both.

You can also check out the following SuiteAnswers article for further information:

- 15270: Setting Default Tax Items on Vendor Records

- 41517: Assigning Subsidiaries to a Vendor

- 11185: Creating a Vendor Record