Round-off is part of legal compliance in India Taxation as per Section 170 of the CGST Act and 288B of Income Tax Act, the correct method of rounding off is normal rounding. So, all the amounts of tax, interest, penalty, refund, or any other amount payable should be rounded off to the nearest rupee as per normal rounding off of tax liability method.

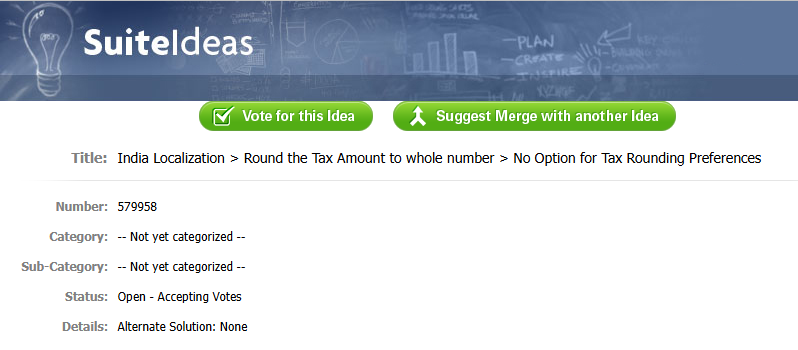

This functionality is however not available in NetSuite and is currently logged as an enhancement in the voting stage [#579958 – India Localization > Round the Tax Amount to whole number > No Option for Tax Rounding Preferences]

The option of rounding off to the nearest decimal point for tax amounts is not available as a preference in the SuiteTax accounts. This is only available for legacy tax accounts with VAT applicability.

Although we do not have the option of automatically rounding off GST amount to the nearest point, we have the option of manually overriding the GST amount on transaction level via the Tax override checkbox. However, this functionality cannot be used if TDS has been applied for the same transaction.

We may use script-based customization for the same, which is what many of the Indian clients currently do.