In the previous article, we covered Deferral Accounts and their significance in relation to the Amortization feature.

Now, let’s take the next step by discussing Amortization Templates. An Amortization Template defines the terms of the amortization schedule created by the purchase of an item.

Once the Amortization feature is enabled, you can create multiple templates to define the terms for deferring expenses. These templates help generate amortization schedules that specify how costs related to associated items and expenses should be recorded.

Before we delve further into the creation of amortization templates, let’s first discuss the permission needed and various types of templates available.

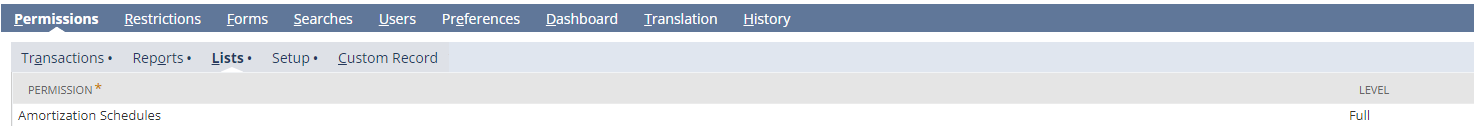

Users can be granted access and the ability to create amortization schedules and templates under the Permissions tab, go to the Lists subtab and look for Amortization Schedules.

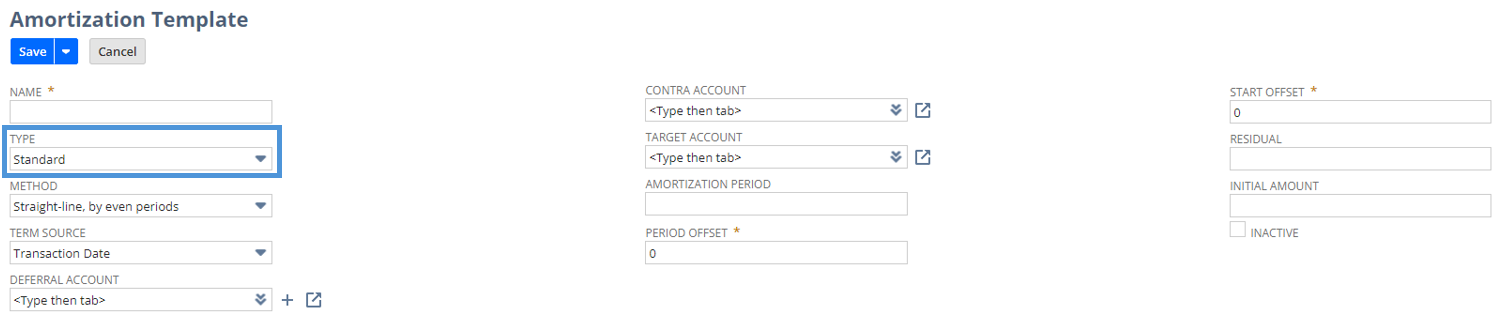

There are two types of templates available in NetSuite:

- Standard – This type requires you to enter a Method and Term Source for the template.

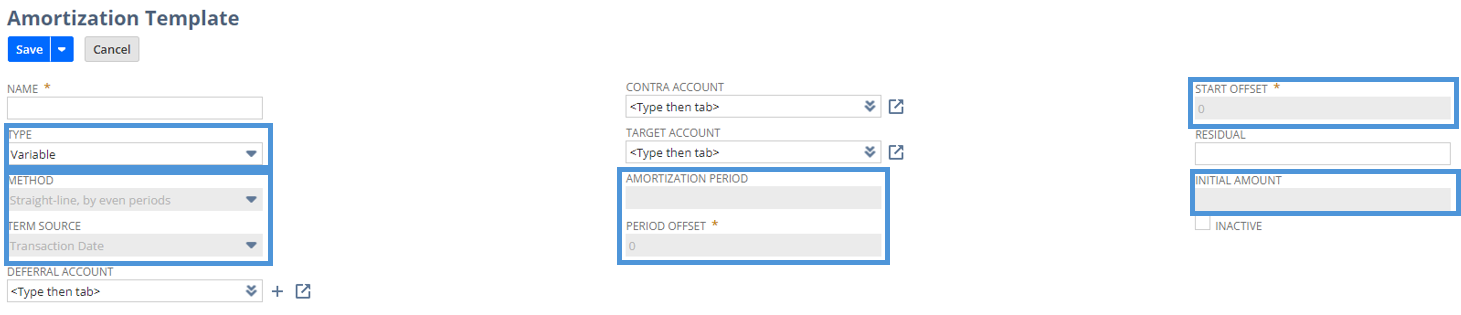

- Variable – Select this type to use this template for percent-complete recognition. Variable templates are selected on item records and amortization amounts are determined by job completion amounts.

This type of schedule is available if the Project Management feature is enabled. For information, see Using Percent-Complete Amortization for Projects.

Note: If you select Variable, you cannot set the following template fields: Recognition Method, Recognition Term Source, Recognition Period, Period Offset, Start Offset, and Initial Amount. Variable amortization scheduled do not include forecast amounts.