In today’s business landscape, where honesty and responsibility are essential, bank reconciliation is important across all industries. It helps ensure that a company’s finances are accurate and reliable, protecting its reputation and stability.

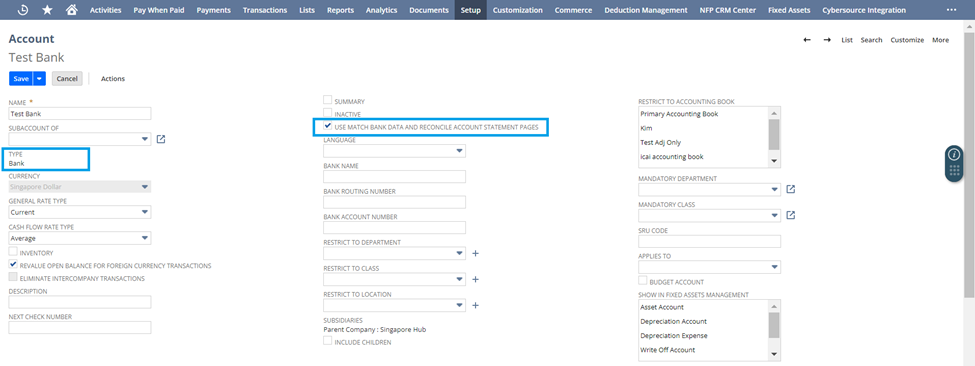

NetSuite provides an application that simplifies the reconciliation process for users utilizing Match Bank Data and Reconcile Account Statement. These processes work hand in hand to enhance the bank reconciliation process, ensuring that users achieve the results they expect. To utilize this feature, one must first establish General Ledger Account, specifically designating them as either a Bank or Credit Card Account Type. This step is a prerequisite for accessing the functionality provided by the checkbox feature. More of this is documented on SuiteAnswer 101099 | Editing Accounts to Use the Match Bank Data and Reconcile Account Statement Pages.

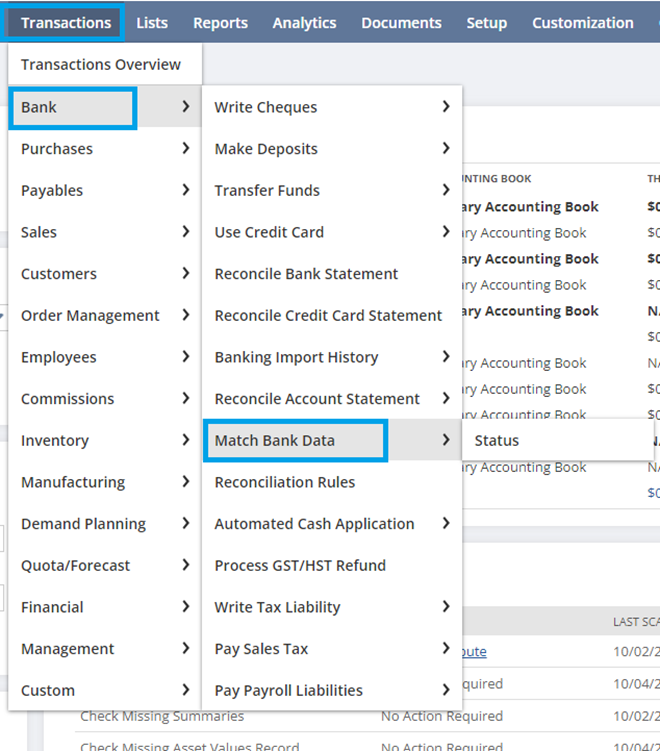

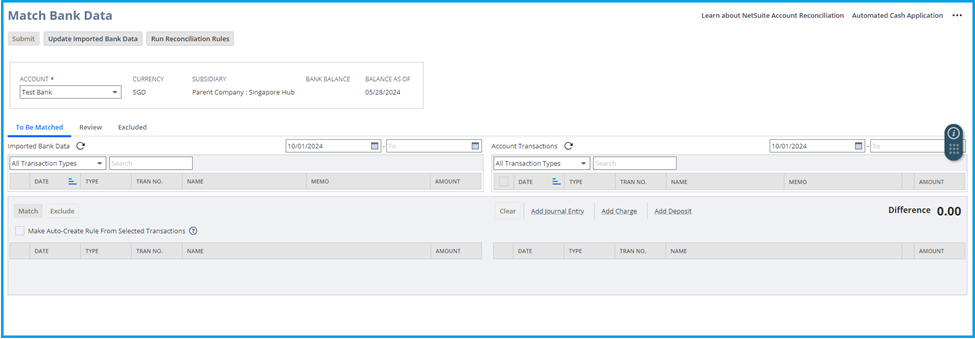

As soon as your Bank or Credit Card Accounts are setup, you may now access Match Bank Data, by navigating to Transactions > Bank > Match Bank Data.

Match Bank Data allows users to easily align their financial records with their actual bank reconciliations. This capability significantly reduces the time accountants spend manually checking bank statements, freeing them up for more strategic tasks. By automating this process, Match Bank Data helps minimize errors and improves overall accuracy.

In addition to reconciliation, Match Bank Data also lets users record transactions in NetSuite that have already cleared the bank but have not yet been entered into the system. This feature ensures that all financial activities are captured promptly, providing a complete view of the organization’s financial standing.

For further reading, here are some comprehensive articles that will guide you through the process of utilizing Match Bank Data. They will provide you with valuable insights and a deeper understanding:

- 65777 | Matching Bank Data

- 98313 | Marking Transactions as Cleared

- 65778 | Viewing Transactions To Be Submitted

- 91273 | Excluding Imported Bank Lines From the Matching Process

- 77454 | Submitting Matched or User-Cleared Transactions

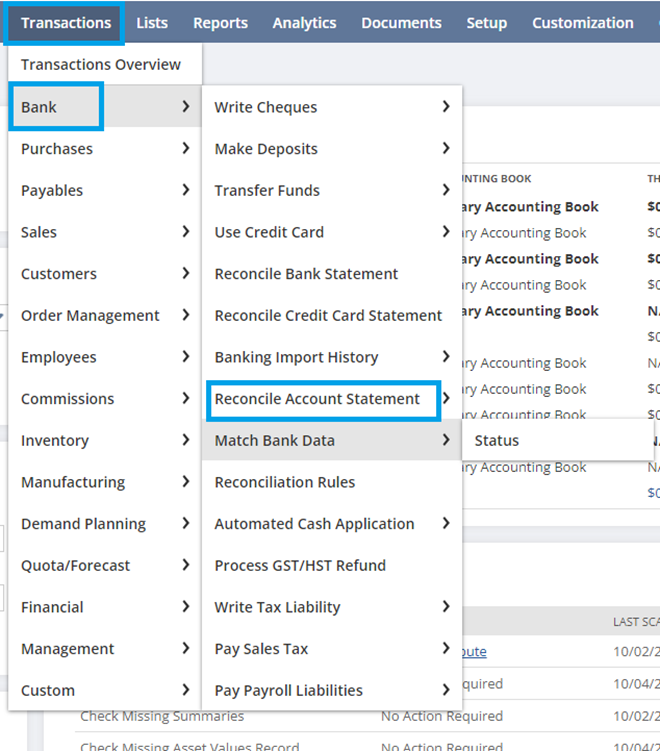

After you submit your matched transactions, you are now ready for Reconcile Account Statement. Here, you can perform the actual reconciliation process seamlessly! To get started, you may navigate to Transactions > Bank > Reconcile Account Statement.

This page will allow you to enter the Ending Statement Balance along with the Statement Date. After that, you’ll need to select all the transactions that should be included in this particular statement. This straightforward approach allows you to ensure that every relevant transaction is accounted for, making it easier to identify discrepancies and maintain accurate financial records.