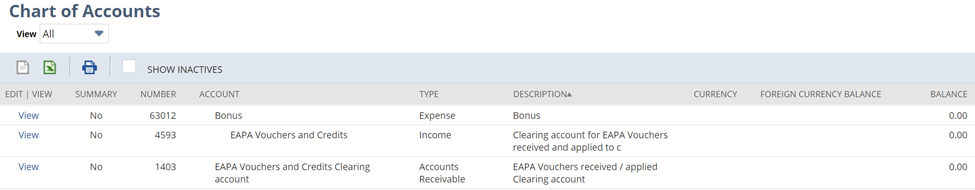

To view the chart of accounts in NetSuite, go to Setup > Accounting > Manage G/L > Chart of Accounts.

Plan and Test the Chart of Accounts Before Implementation

NetSuite offers a test environment called the Sandbox, where users can plan, test, and observe each activity at every stage of implementation. Using the test environment can help validate data and detect errors or complications that may arise during and after implementation.

Categorize the Account List Properly

One of the keys to having a well-organized chart of accounts is to categorize correctly to get accurate reports and insights about the business’s performance. The chart of accounts in NetSuite provides a set of destinations for the posted transactions and categorizes them into Assets, Expenses, Income, Liabilities, and Equity. These categories are used to track and report monetary data. In the advanced financial module, NetSuite has another category called Statistical Account that is used to track non-monetary data.

| Account Type | Category |

|---|---|

| Accounts Receivable | Asset |

| Bank | Asset |

| Fixed Asset | Asset |

| Other Asset | Asset |

| Other Current Asset | Asset |

| Unbilled Receivable | Asset |

| Equity | Equity |

| Cost of Goods Sold | Expense |

| Expense | Expense |

| Other Expense | Expense |

| Income | Income |

| Other Income | Income |

| Accounts Payable | Liability |

| Credit Card | Liability |

| Deferred Revenue | Liability |

| Long Term Liability | Liability |

| Other Current Liability | Liability |

Make Use of NetSuite Classification

NetSuite classifications, such as Department, Classes, and Location, help users better organize their accounts and preserve accuracy. This feature helps minimize the creation of too many accounts. For example, instead of creating a separate salary expense for Marketing, Finance, Sales, and other departments, users can simply create one account and tag the specific department.

Departments are useful when designating a transaction to an employee who is a member of a specific internal team; this can help track the income and expenses of each department over any period of time in the reports. Classes, on the other hand, are useful for wider segments to track where income and expenses are generated. For example, users can create Classes to track where the Finance department sources its office expenses. Through Classes, users can determine if Finance sources from new suppliers or repeat suppliers. Purchase orders would then indicate whether the transaction was created for new or repeat suppliers. Users with the Administrator role can use the Locations feature to keep track of employees and transactions across multiple offices or warehouses.

Align the List Based on the Company’s Needs

There isn’t a standard chart of accounts for every business. The accounts that are included in a company’s financial statements are determined by the nature of its operations.

For example, a liability account should not be used by a company that uses cash-basis accounting. Similarly, if the company is a service, an inventory account is not required.

Use a Short but Clear Account Description

Take advantage of the account description field in the chart of accounts of NetSuite, which is the most straightforward method of describing how to use the accounts. It should specify when and for what types of transactions the account should be used. A clear description helps avoid confusion.

Use Account Numbers

NetSuite users have the option to use the standard account numbering set by the system or to create their own. Accounts numbers are another way to classify transactions, helping group accounts that are similar in nature. For example, in the standard numbering set by NetSuite, all accounts that start with the number 1 should be considered asset accounts, all accounts that start with number 2 will be considered liability accounts, and so on. To enable the use of account numbers, go to Setup > Accounting > Preferences > Accounting Preferences (Administrator access only). Click the General subtab and mark the box beside Use Account Numbers. Click Save.

When users enable the Use Account Numbers preference, four-digit account numbers are automatically paired with existing accounts, such as the following:

| Account Name | Account Number |

|---|---|

| Asset accounts | 1xxx |

| Liability accounts | 2xxx |

| Equity accounts | 3xxx |

| Income accounts | 4xxx |

| Cost of Goods Sold (COGS) accounts | 5xxx |

| Expense accounts | 6xxx |

| Other Income accounts | 8xxx |

Account numbers can be alphanumeric, with a maximum of 60 characters.

Do Not Create Too Many Accounts

Creating too many accounts may lead to confusion: It can make it difficult to categorize transactions, which may also lead to charging erroneous accounts. For example, users may find it perplexing as to which account they should use if both Utilities and Telephone accounts exist.

Another concern that could develop from having too many accounts is an increase in the cost of an audit. An external auditor could take longer than normal to audit an extensive chart of accounts.

Be Consistent with the Chart of Accounts

Consider the future when establishing the chart of accounts. Businesses frequently make comparisons between their past and present performance. Changing the chart of accounts regularly will have an effect on the financial report’s historical data.

Consolidate and Simplify Accounts

NetSuite users also have the ability to customize accounts: They can add, edit, merge, or delete accounts as needed. Accounts that are redundant, unhelpful and out of date should be deleted, while those of the same type can be edited or merged. Users can amend accounts at any point during the year as long as the appropriate changes to the related entries have been made.

When it comes to deleting an account, though, users should wait until the end of the year. The activity in an account prior to its deletion will not be reflected if it is deleted in the middle of the year. This has an impact on the accuracy of the financial record; thus, if a user decides not to use a specific account, they should wait until the end of the year to remove it.

Be Aware of NetSuite Limitations

- Users cannot change the account type for an account that has associated posting and non-posting transactions, such as sales orders and revenue commits.

- Users cannot create a new account or update an existing account with an account number that already exists. Attempting to do so will prompt an error showing that the account number is already used.