- Sales orders are non-posting transactions that record the items or services a business plans to sell to the customer.

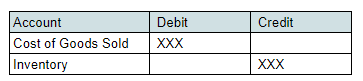

- Order fulfillment is the process of fulfilling the sales order of a customer. Example: To fulfill the order, the business will have to pull out some items from its inventory, which will result in a decrease in assets and an increase in the cost of sales or cost of goods sold (COGS), the total amount spent on the item sold.

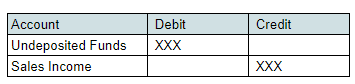

- Cash sales are recorded when a customer pays for items at the time of sale. This can occur in the form of cash, credit cards, or checks.

Example: A customer pays cash for the items received, which will increase the asset and sales income.

Note: Undeposited funds are just a holding account for the payments received that are not yet deposited to the bank. Examples are cash and post-dated checks.

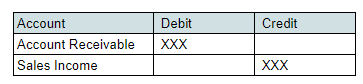

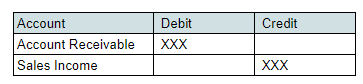

- Invoices are issued to customers to record income that the business is expecting to receive.

Example: The customer applies for a credit term and promises to pay the items within 30 days. This will increase both the asset and income accounts.

5. Statement charges are similar to invoices and are used to enter several charges that accumulate over a specific period. The GL impact will show an increase in the expected receivables and income.