The following is an example of the calculation that NetSuite uses to determine the consolidated exchange rates for subsidiaries with the following hierarchy:

- U.S. Subsidiary is parent-subsidiary, base currency is USD

- U.K. Subsidiary is child subsidiary, base currency is GBP

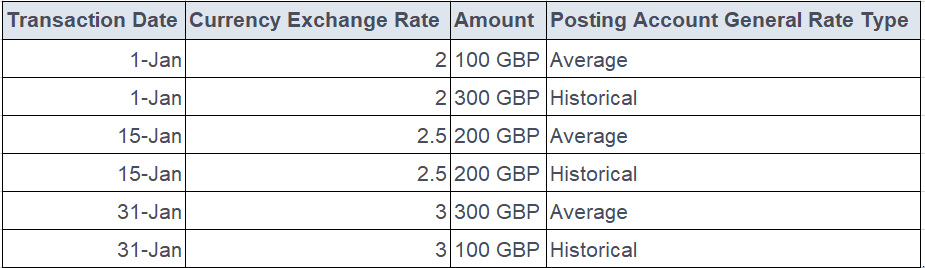

The transactions during the period of January for the U.K. subsidiary are listed in the following table:

When you click Calculate at the top of the Consolidated Exchange Rates page, the consolidated exchange rates from the U.K. subsidiary to the U.S. Subsidiary are derived as follows:

- Current rate uses the GBP to USD rate from the Currency Exchange Rates list as of the end of the period (January 31).

- Current rate = 3

- Average rate is a weighted average based on transactions amounts posted to all accounts with a general rate type of Average. The currency exchange rate for each transaction is the GBP to USD rate in effect on the transaction date.

- Average rate = (2 × 100 + 2.5 × 200 + 3 × 300) ÷ 600 = 2.6666667

- Historical rate is a weighted average based on transactions amounts posted to all accounts with a general rate type of Historical. As for the average rate, the currency exchange rate for each transaction is the GBP to USD rate in effect on the transaction date.

- Historical rate = (2 × 300 + 2.5 × 200 + 3 × 100) ÷ 600 = 2.3333333