COGS are not expense accounts, but they function like an expense. These are the costs directly associated with the sale of goods or services. This includes the cost of the product for resale, raw materials, packaging, etc. General selling expenses, such as salaries, rent, utilities, and advertising expenses, are not considered part of the cost of goods sold.

COGS and inventory go hand in hand: The cost of an item is determined when it is added to inventory via purchase or an inventory adjustment. The price of the item on the purchase order determines the item’s cost.

The exact cost is determined based on the costing method used by the business. The three most commonly used methods are:

- First-in, First-Out (FIFO): This method assumes that the oldest units are sold first; hence the ending inventory consists of the most recent purchased goods.

- Last-In, First-Out (LIFO): This method assumes that the newest units are sold first; hence, the ending inventory consists of the oldest units purchased.

- Average Costing: In this method, COGS is calculated as the total units available during a period divided by the beginning inventory cost plus the cost of additions to inventory. This is the default costing method in NetSuite.

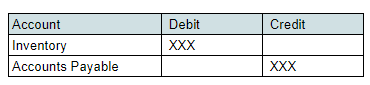

Example: A business purchased an item for resale. The GL impact will show an increase in assets and payable accounts.

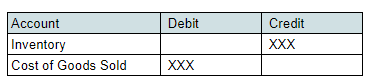

When the purchased item is sold, the GL impact will show an increase in COGS and a decrease in the asset account.