Use the statutory adjustment journal to adjust the calculated CGST, SGST/UTGST, or IGST on advance receipt or payment at the time of supply of goods and services.

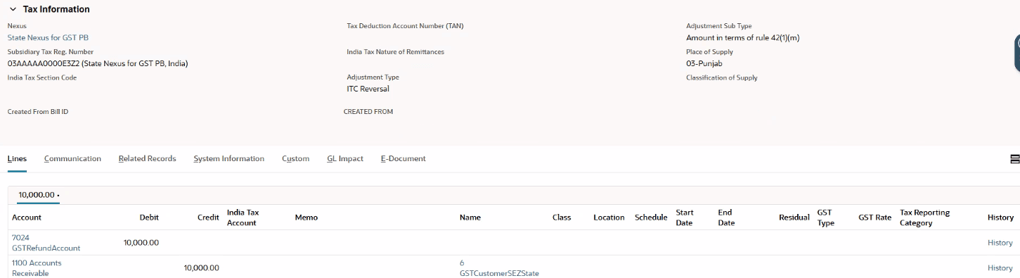

In addition, you can also use statutory adjustment journal to enter ITC (Input Tax Credit) reversal adjustment for GST claims in case you do not meet the specific ITC claim conditions. For example, entering late fees or interest liabilities for a purchase transaction.

Statutory Adjustment Journal records are reflected in the GST3B report under section 5.1 Interest & Late Fee Payable.