According to SuiteAnswers 7734 || Consolidated Exchange Rates,

If you use NetSuite OneWorld and have multiple base currencies, NetSuite maintains a page of consolidated exchange rates at Lists > Accounting > Consolidated Exchange Rates. Consolidated exchange rates ensure that currency amounts translate properly from child to parent subsidiaries for consolidated reports. The page includes consolidated exchange rates between the base currencies of each subsidiary and its parent or grandparent subsidiary for a specified accounting period.

As further discussed in SuiteAnswers 7728 || Consolidated Exchange Rate Types,

The Consolidated Exchange Rates table includes three consolidated exchange rate types. Current, Average, and Historical.

Average – The weightedaverage of the currency exchange rates for all transactions posted during the period to accounts with a rate type of Average. This rate is used to translate accounts in the income statement and to build retained earnings.

Current – Also referred to as endingrate. This rate is the currency exchange rate that is effective at the end of the reported upon period. This rate is used for most asset and liability accounts in the balance sheet.

Historical – Same as Average rates, except for accounts with a rate type of Historical. This rate is used for equity accounts and owners’ investments.

Due to the different sources of these rates, users expect that these rates will also have different values. However, there are times that the rates are the same. Below are the most common reasons why Current, Average and Historical Consolidated Exchange Rates will have the same values:

- The Child and its Direct Parent’s base currencies are the same. In this instance, there will be no roll-up, thus, the Current, Average and Historical Consolidated Exchange Rates between the Child <> Direct parent are all 1.00.

- As mentioned above, Average and Historical rates are the weighted average of all transactions posted to accounts which has Average and Historical rates as its General Rate Type within a specified period. Even though there are qualified transactions posted to the child subsidiary and its base currency is different from its direct parent, those transactions might have been posted to the Child subsidiary in the month-end. In this case, the system will just get the month-end rate as the basis of the Average and Historical rates, which is technically also the Current rate being the ending rate.

- In a Root Parent <> Child <> Grandchild Subsidiary hierarchy, transactions are posted to the Grandchild subsidiary. However, the Average and Historical rates are still not calculated by the system and are instead the same with the Current rate. According to SuiteAnswers 107607:

Even though there are qualified transactions for these, it is not expected that these transactions will affect the Consolidated Exchange Rates of the Parent subsidiary. This is due to the system limitation logged under Enhancement #221439: Consolidated Exchange Rates>Have the ability to affect the consolidated exchange rate of the child subsidiary to root parent for transactions made by the grandchild subsidiary (derived or indirect rates)

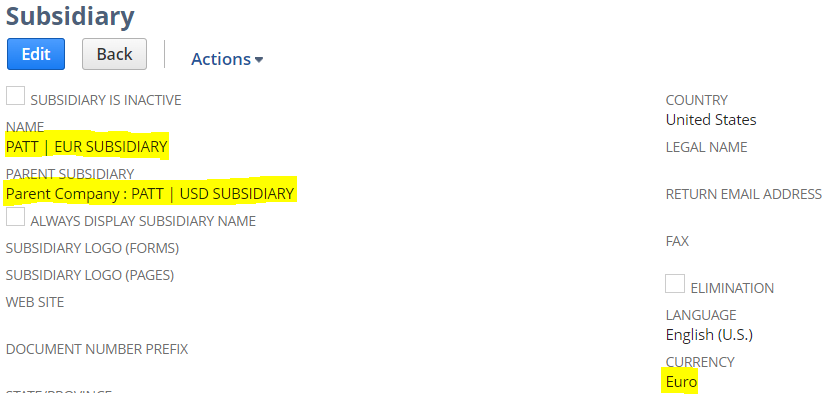

To better explain points #1 to #3 below are some illustrations. For Illustrations I and II, this set of subsidiaries will be used in the demonstrations:

- Parent Company – Root Parent subsidiary (Base Currency is USD)

- PATT | USD SUBSIDIARY – Child subsidiary (Its Direct Parent is Parent Company and its Base Currency is USD)

- PATT | EUR SUBSIDIARY – Grandchild subsidiary (Its Direct Parent is PATT | USD SUBSIDIARY and its Base Currency is EUR)

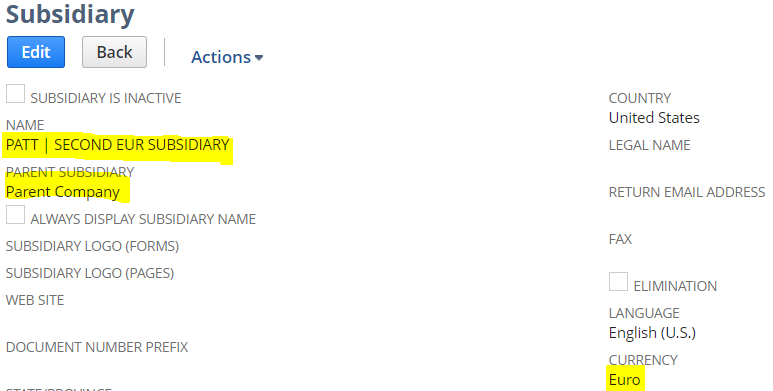

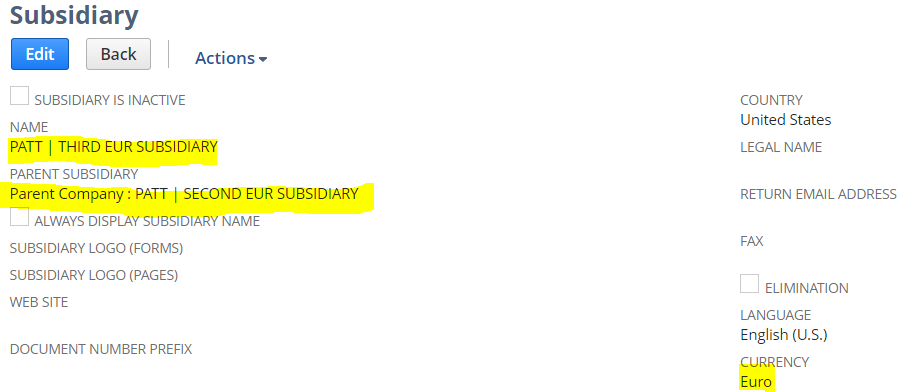

On the other hand, the below subsidiaries will be used for Illustration III:

- Parent Company (same as above) – Root Parent subsidiary (Base Currency is USD)

- PATT | SECOND EUR SUBSIDIARY – Child subsidiary (Its Direct Parent is Parent Company and its Base Currency is EUR)

- PATT | THIRD EUR SUBSIDIARY – Grandchild subsidiary (Its Direct Parent is PATT | SECOND EUR SUBSIDIARY and its Base Currency is EUR)

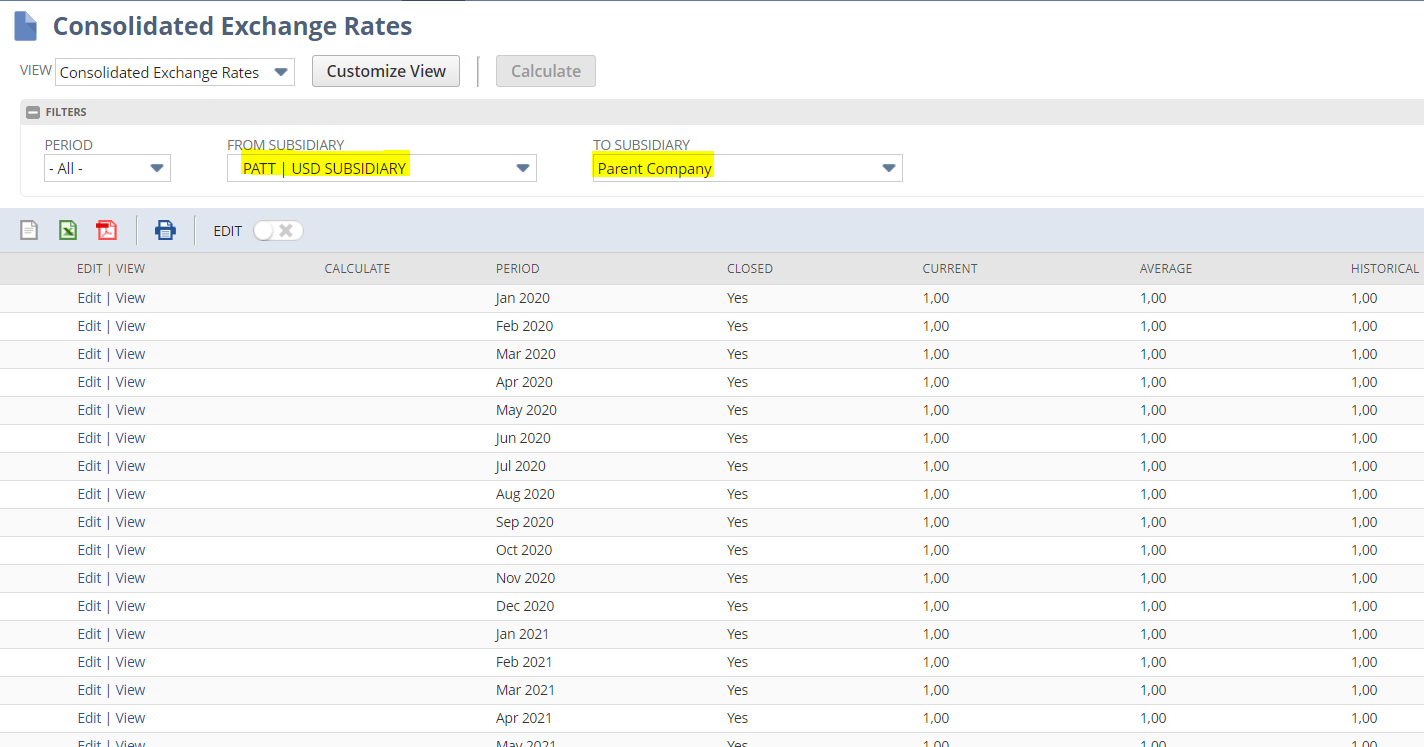

ILLUSTRATION I: PATT | USD SUBSIDIARY and its Direct Parent, Parent Company, have the same Base Currencies (USD). Even though there are transactions posted to the Child subsidiary, we can observe in Lists > Accounting > Consolidated Exchange Rates that the Current, Average and Historical Consolidated Exchange Rates between these are all the same, which is 1.00.

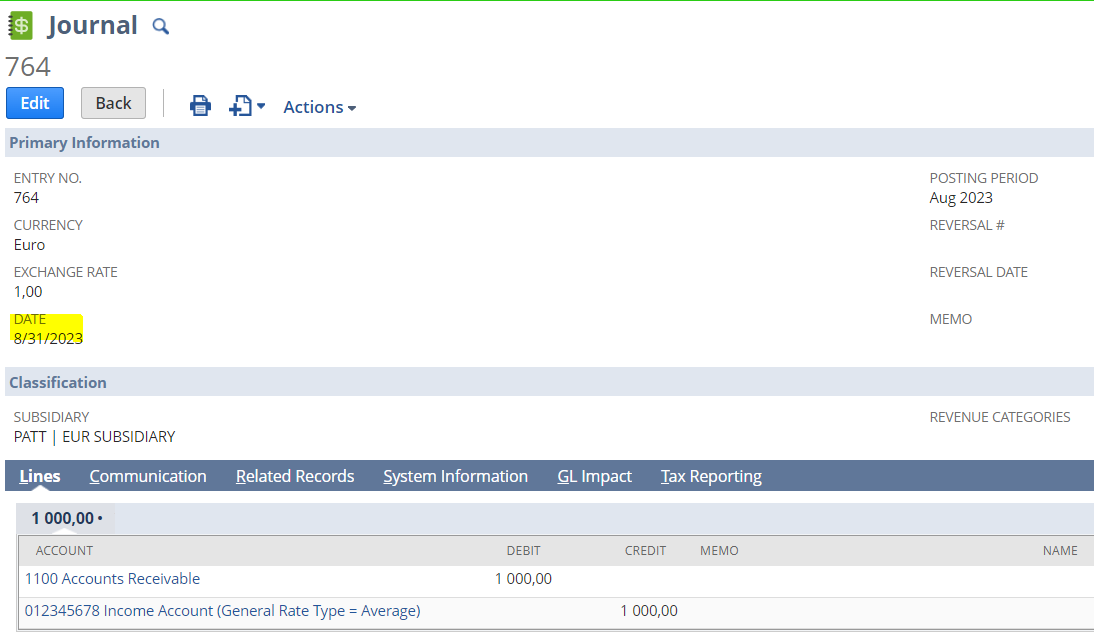

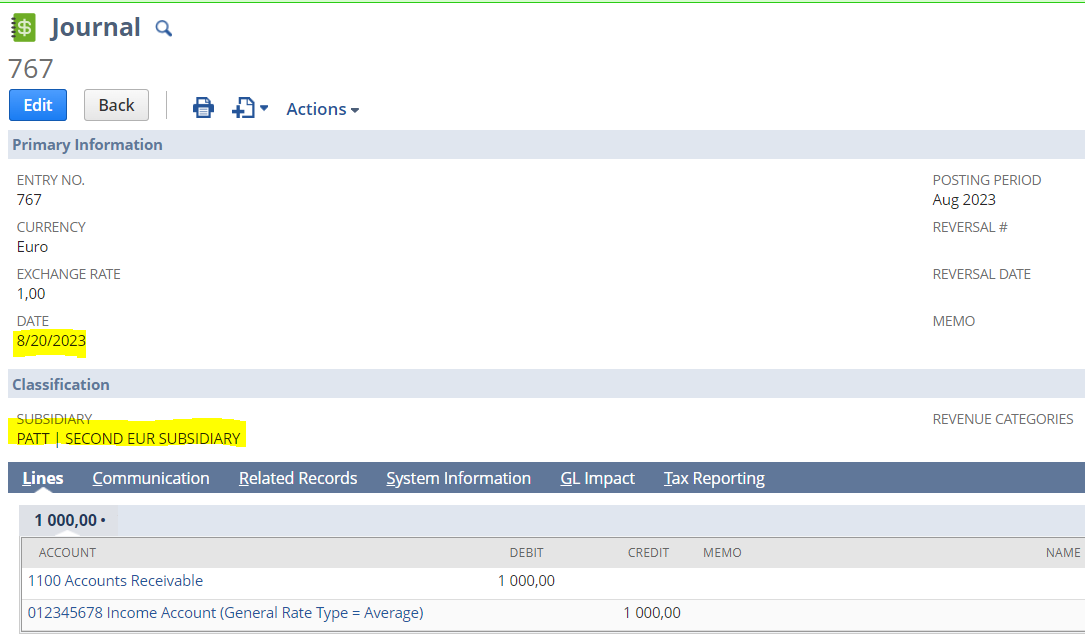

ILLUSTRATION II: There is a Journal Entry posted to PATT | EUR SUBSIDIARY and used an Income Account with General Rate Type = Average in August 31, 2023.

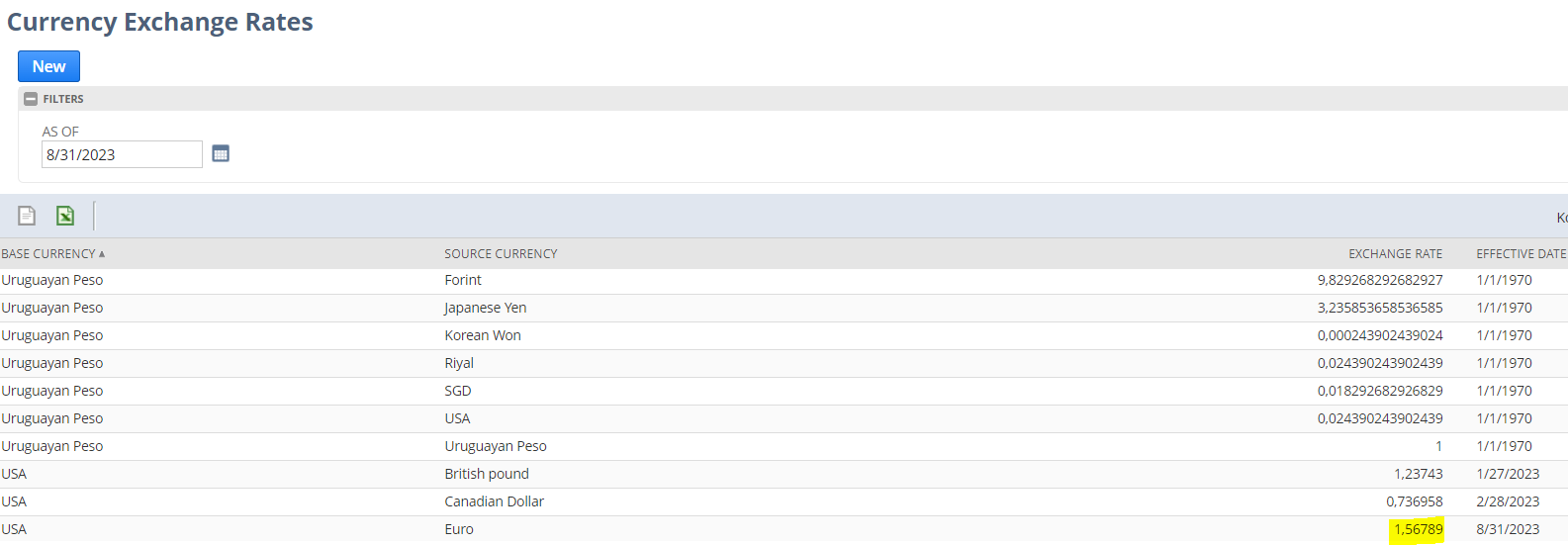

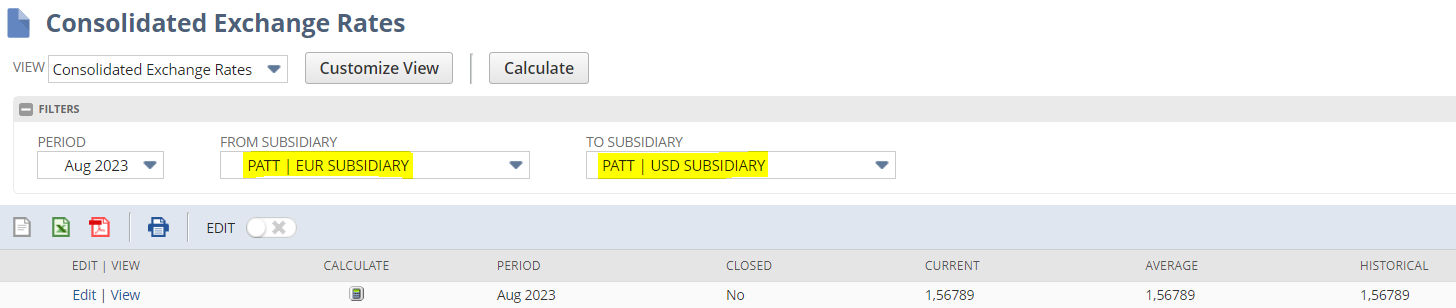

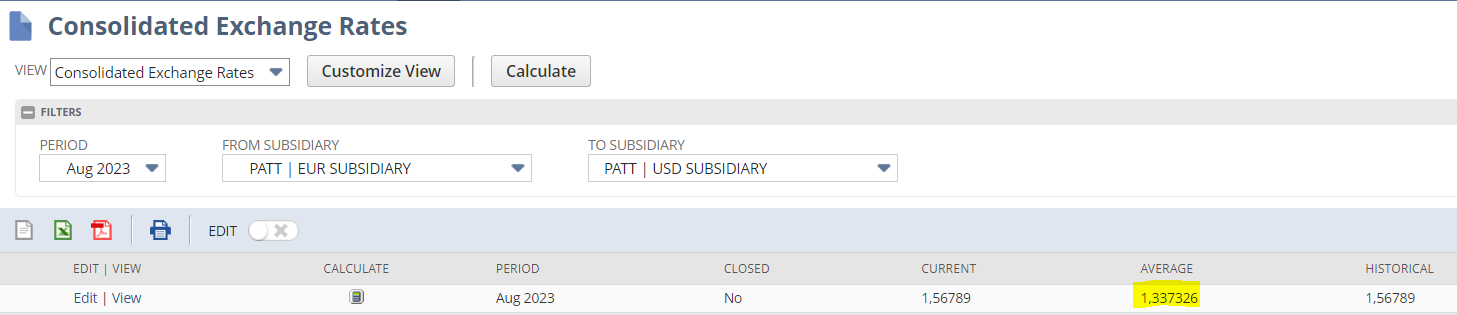

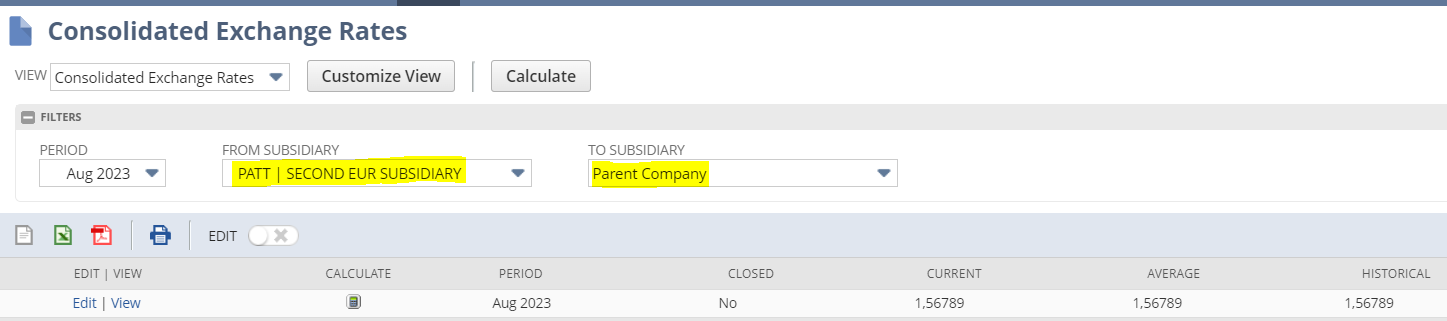

Upon checking the Consolidated Exchange Rates page, the Current, Average and Historical rates between PATT | EUR SUBSIDIARY and its Direct Parent PATT | USD SUBSIDIARY are all 1,56789, which is the effective Currency Exchange Rate between USD<>EUR on the same date.

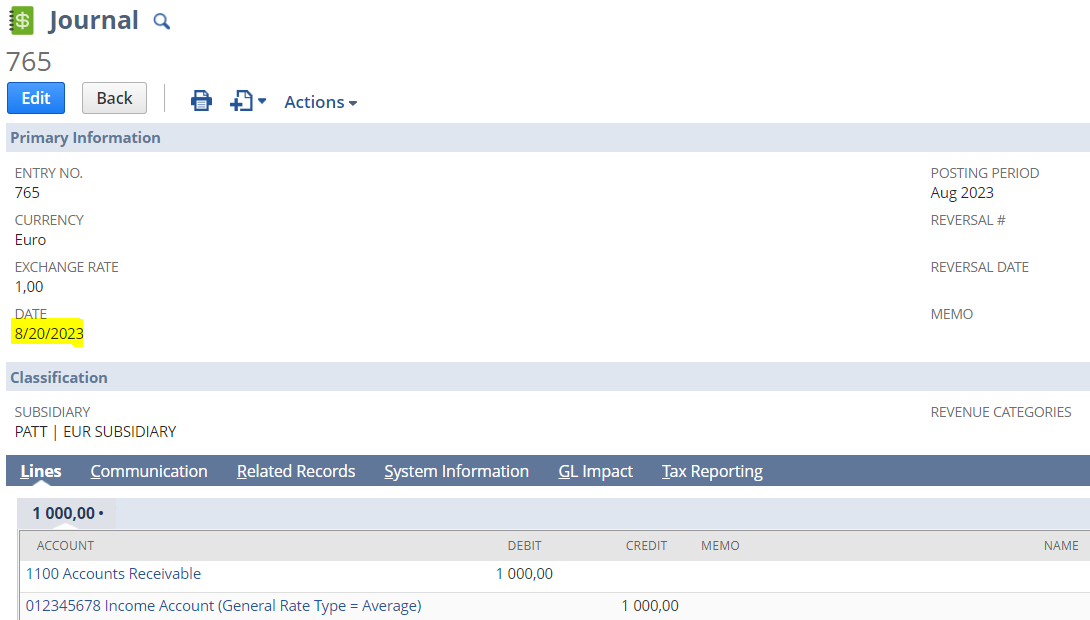

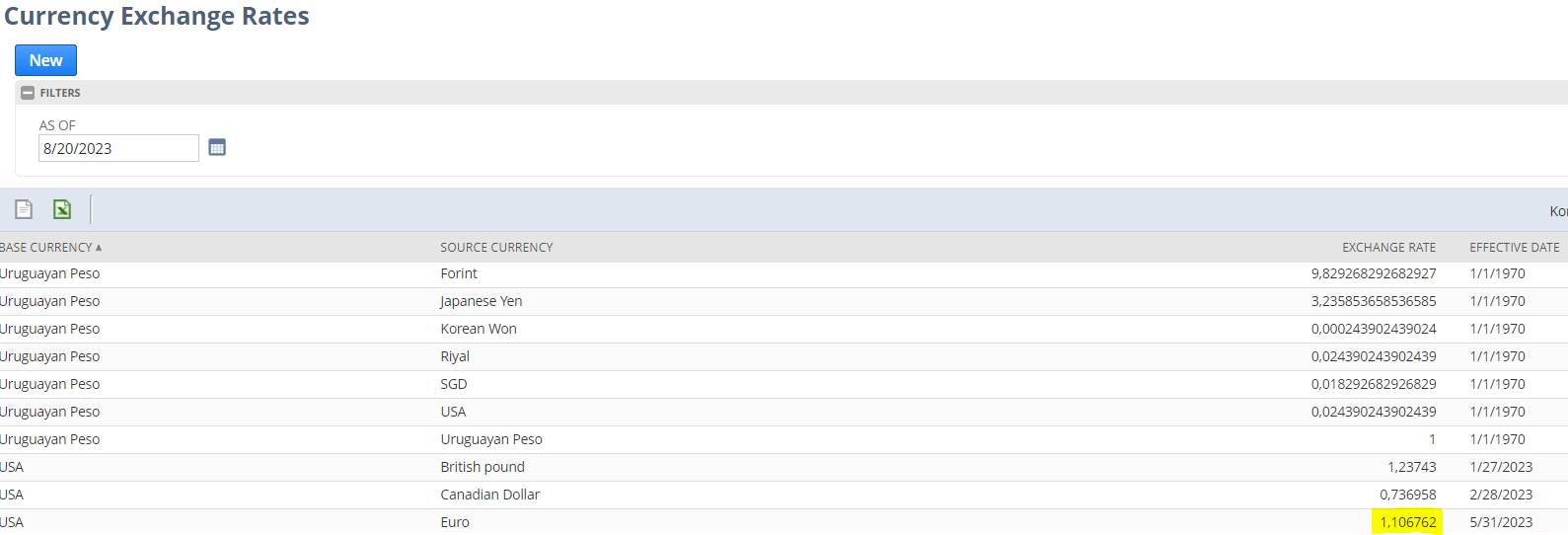

The outcome is not the same when we create another Journal Entry with the same setup except date is August 20, 2023. As of this date, effective Currency Exchange Rate is 1,106762, which is evidently different from the ending rate of 1,56789.

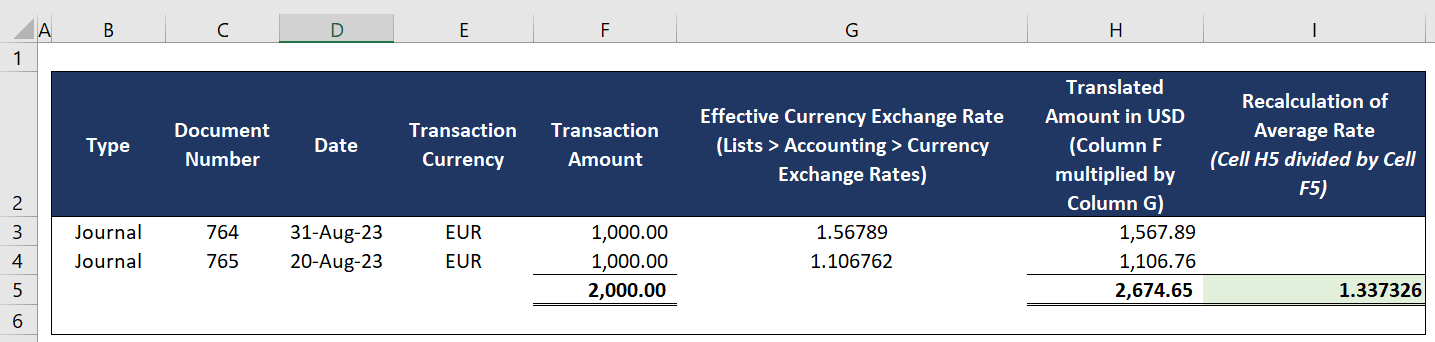

After recalculating the Consolidated Exchange Rates, the Average rate becomes 1,337326, which is computed by the system as follows:

To verify Average rates, you may follow SuiteAnswers 46610 || Compute for the Average Consolidated Exchange Rate. This is also applicable to Historical rates, just change the Criteria General Rate Type to Historical.

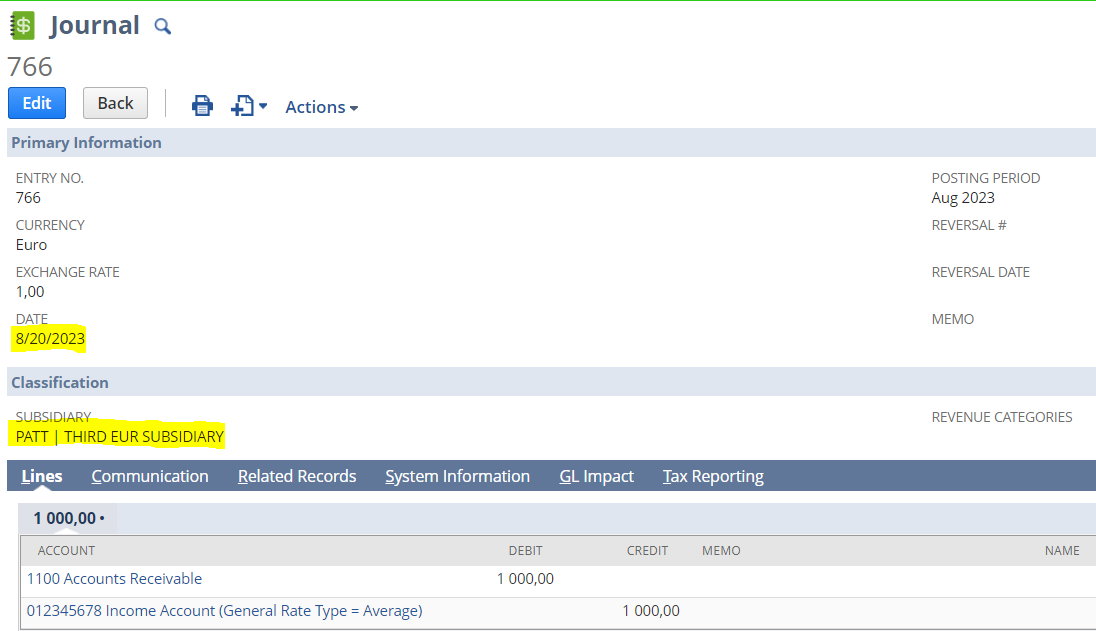

ILLUSTRATION III. There is a Journal Entry posted to the Grandchild subsidiary PATT | THIRD EUR SUBSIDIARY and used an Income Account with General Rate Type = Average in August 20, 2023. The effective Currency Exchange Rate on this date is 1,106762. Upon checking the Consolidated Exchange Rates page, Current, Average and Historical rates between PATT | SECOND EUR SUBSIDIARY and the Root Parent subsidiary Parent Company are all 1,56789, which is the effective Currency Exchange Rate between USD<>EUR on August 31, 2023.

In conclusion, the Journal Entry posted to the Grandchild subsidiary made on impact on the Average rate between the Child subsidiary PATT | SECOND SUBSIDIARY and the Root Parent subsidiary Parent Company:

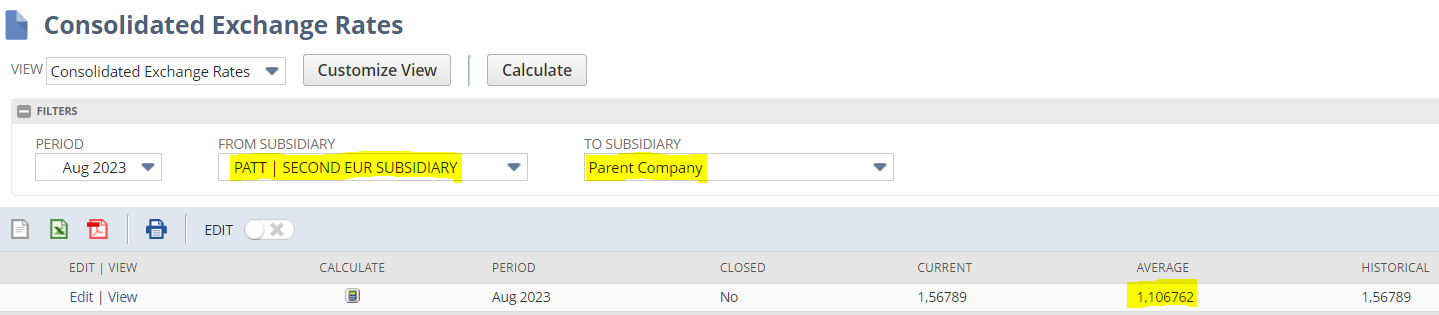

The outcome is not the same when we create another Journal Entry with the same setup except subsidiary is PATT | SECOND EUR SUBSIDIARY.

After recalculating the Consolidated Exchange Rates, the Average rate becomes 1,106762, which is computed by the system as 1,067.62 divided by 1,000.00 (since this is the only transaction posted to the PATT | SECOND EUR SUBSIDIARY).

To summarize, Current, Average and Historical rates will be the same if:

- The base currencies of the Child subsidiary and its Direct Parent are the same;

- The qualified transaction is posted in the month-end; and

- The transaction is posted to the Grandchild subsidiary instead of the Child subsidiary in a Root Parent <> Child <> Grandchild Subsidiary hierarchy.