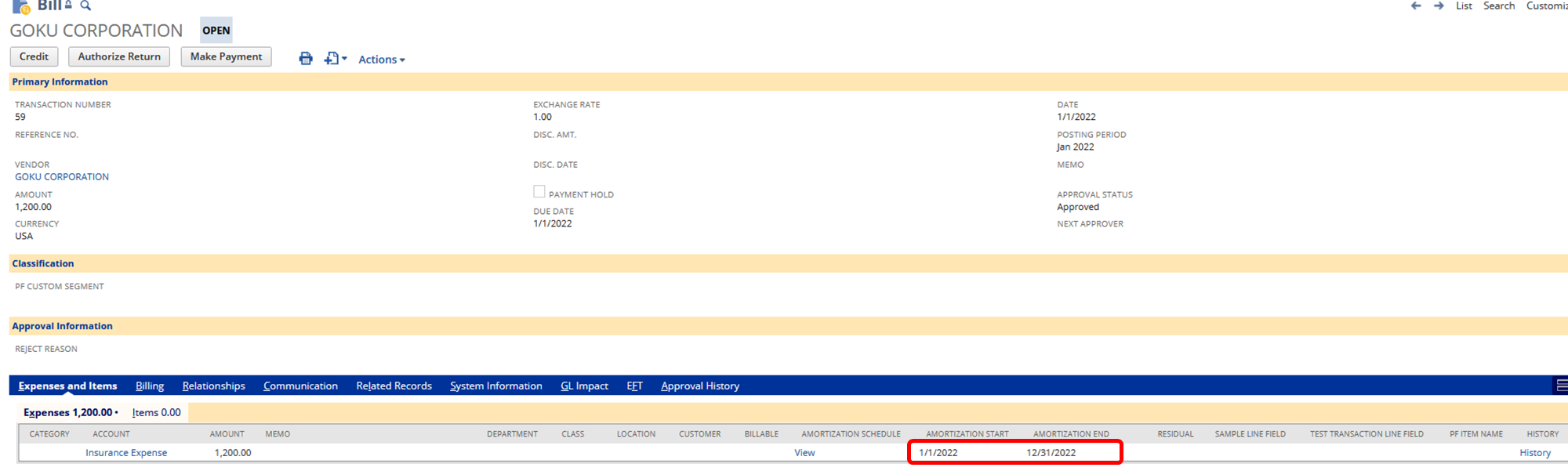

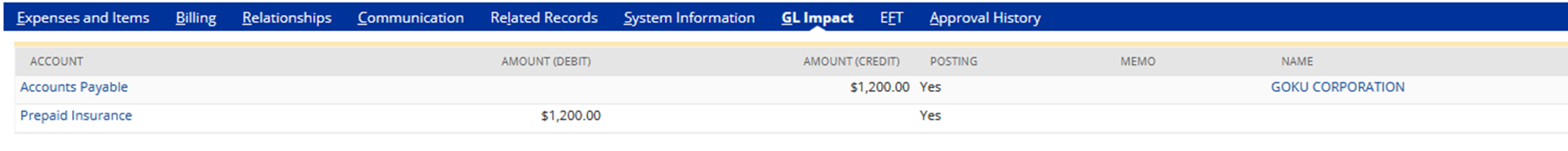

Scenario: Prepaid Insurance was bought last January 1, 2022 and is expected to be amortized in 12 months, so the accounting team set the Amortization start date to 1/1/2022 and the end date to 12/31/2022.

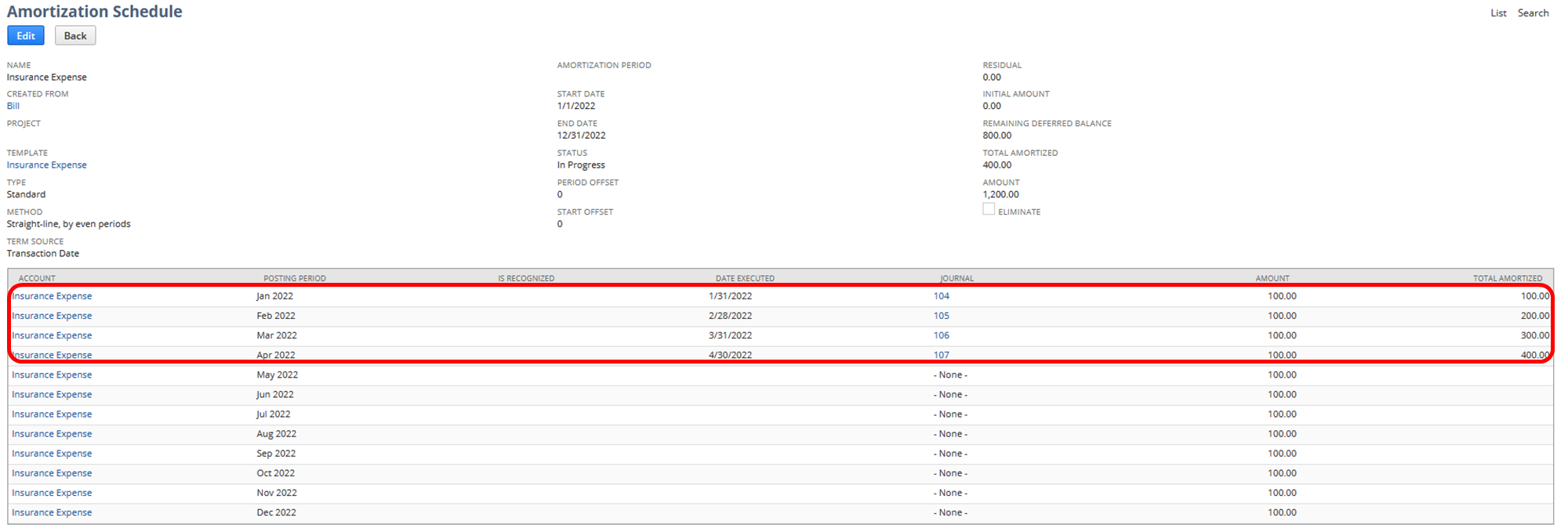

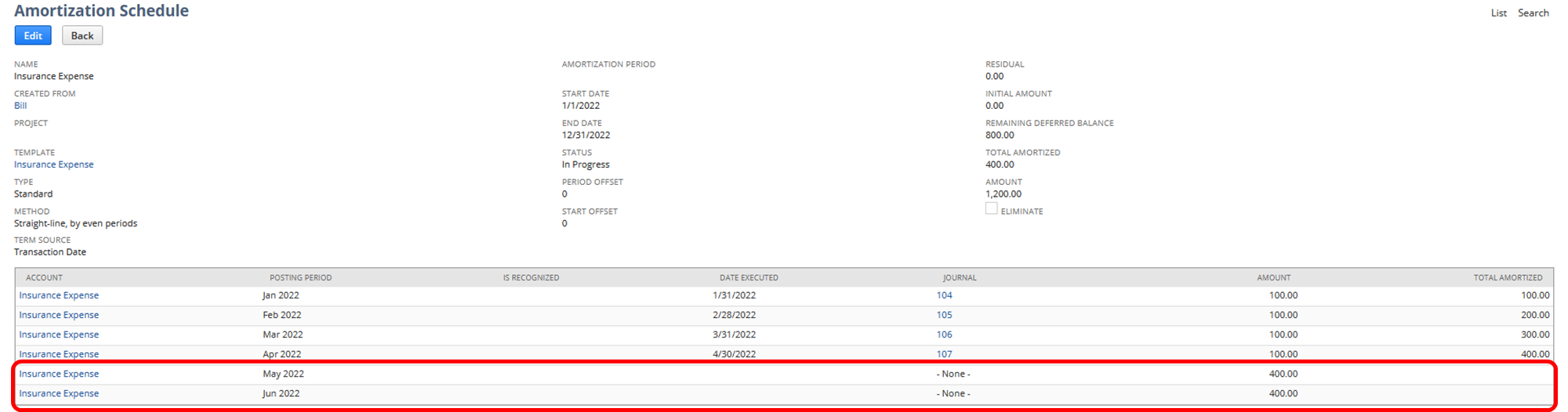

Last May 2022, it was found out that the prepaid insurance will expire on June 30, 2022 instead of December 31, 2022, however, the periods from Jan to April 2022 was already closed and amortization journal entries was already posted:

User wants to amortize the remainder of the Prepaid Insurance for the last remaining months equally (May 2022 and June 2022), to be able to adjust the schedule the following settings should be satisfied:

1. The accounting preference Allow Users to Modify Amortization Schedule = True

2. The role has been granted with at least Edit permission for Amortization Schedules

3. The amortization line is not yet recognized/amortized

Note: The amortization-related data (Amort. Schedule/Template, Start Date, End Date) on the source transaction may only be changed or removed if there are no amortization made yet.

Please check SuiteAnswers Id: 86261 | Editing an Amortization Schedule

Users can now edit the amortization schedule:

1.) Click Edit on the Amortization Schedule

2.) Remove lines from Jul 2022 to Dec 2022

3.) Change the amount of these posting periods

May 2022 – $200

Jun 2022 – $200

The new amounts should equal to the remaining deferred balance of $800 ($400 was already recognized) to be able to save the amortization schedule, since the line amount’s total is $1,200

4.) Save

Result:

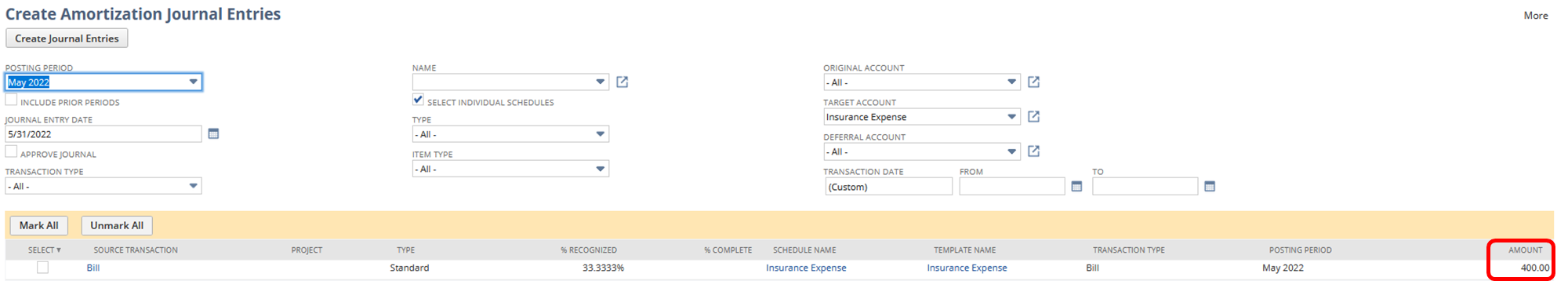

The change in amount will be automatically reflected in Create Amortization Journal Entries: