This section will explain the fields displayed on the GL Impact page and the types of transactions that generate GL Impact.

GL Impact Page Fields

- Accounting Book: This field will show up only if the Multi-Book accounting feature is enabled and provides the ability to maintain multiple sets of accounting records. For example, a company that follows US GAAP can add accounting books to generate different financial reports and statements required by local governments or industry regulations.

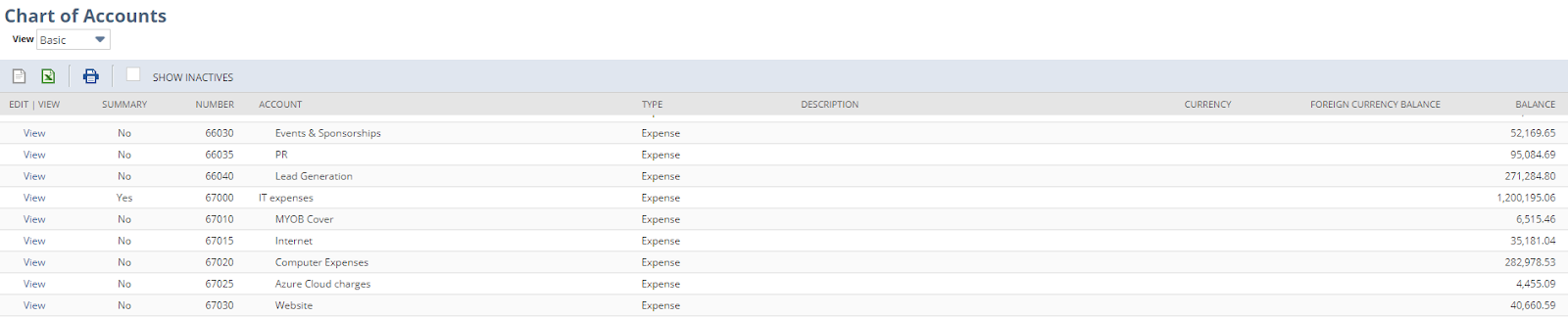

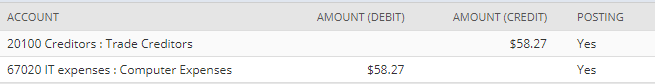

- Accounts: These are the names and numbers found in the account chart used to classify financial transactions.

3. Amount: This shows the financial value of transactions. They are always displayed two-sided: debit and credit. The amounts on both sides should be equal, but the entries of the accounts should be the opposite.

For example, an increase in an expense account might decrease the asset if paid in cash or increase liabilities if charged to the account.

- Posting: This indicates whether a transaction is posting or non-posting. Posting transactions affect the balances in the general ledger or financial reports, whereas non-posting transactions are planned activities that are not yet final and therefore do not affect the GL balance. Sample posting transactions are invoices issued to customers, bills issued by suppliers, credit memos, and checks. Purchase orders, estimates, and quotations are just a few examples of non-posting transactions.

- Memo: This is a free-text field used to enter additional information about transactions.

- Name: This field displays the customer’s name or the vendor related to the transaction.

- Subsidiary: Businesses can create multiple subsidiaries, each representing a separate company.

- Department/Class/ Location: NetSuite classification features help users organize their accounts effectively. They assist in determining the total revenues or expenses of each department, class, or location.

- Custom Script: This column links to the implemented Custom GL Lines Plug-in, allowing users to create a custom GL impact line on transactions like invoices and vendor bills across single or multiple accounting books, removing the need for manual journal entries.