The Revenue Recognition End Date source determines how and when the end date will be computed and determined in a Revenue Plan. Users have options to set this according to their need. Some of the options include Recognition Period and Terms in Months.

When Recognition Period the end date is derived from the revenue plan start date and the value in the Recognition Period field. The end date in the revenue plan is the last day of the period, and partial periods are included in the count. However, when Terms in Months is used, the end date is derived from the revenue plan start date and the value in the Term in Months field. Exact months are used.

Here is an example:

2 revenue recognition rules were created both are using the same recognition method (Straight-line, by even periods), rev rec start date source (same start date) and amount source:

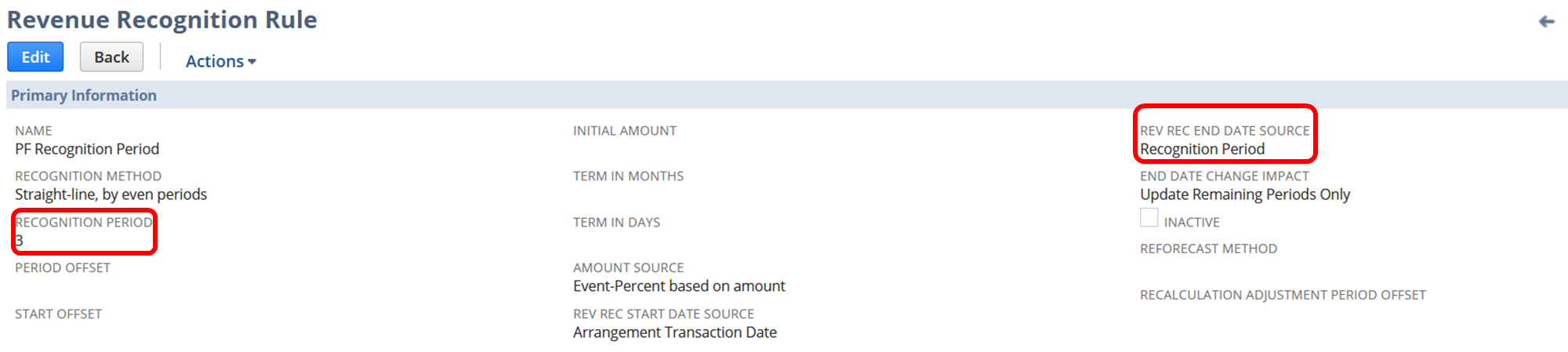

Recognition Period

Recognition period = 3

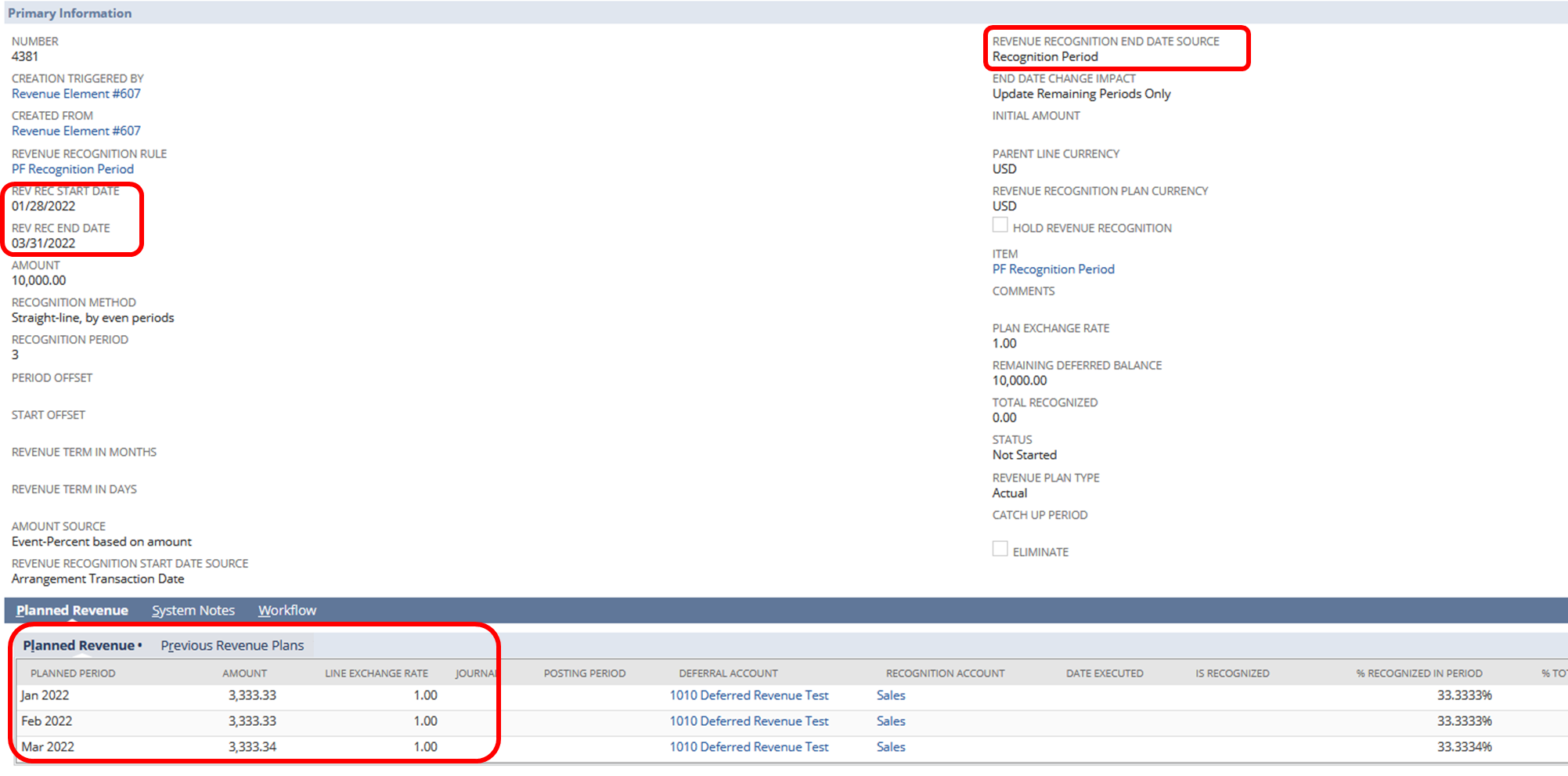

Revenue Plan:

The revenue recognition end date will end exactly after 3 periods – March 31, 2022, which is the last day of that period. It counts January 28 – 31 as a whole month in determining the 3 periods.

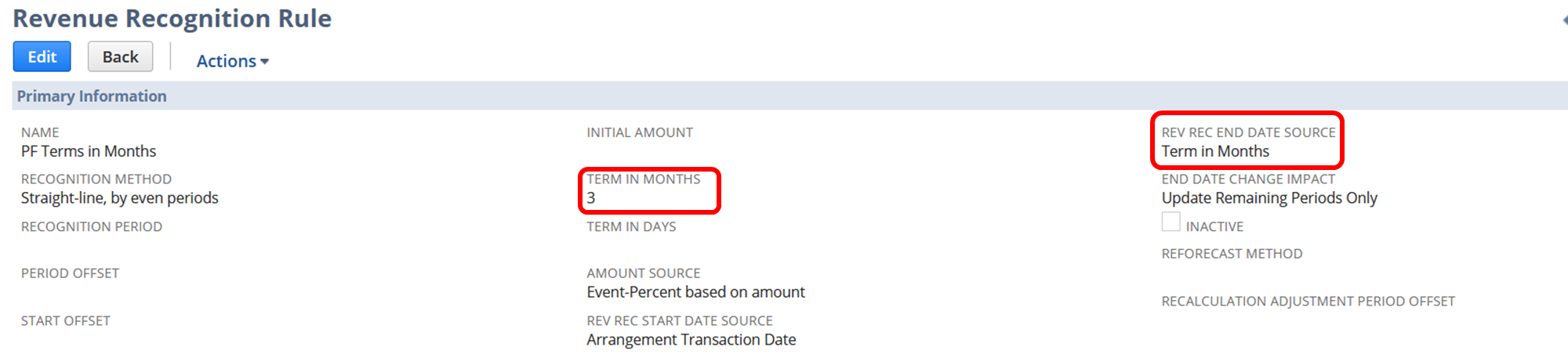

Recognition Period – Term in Months = 3

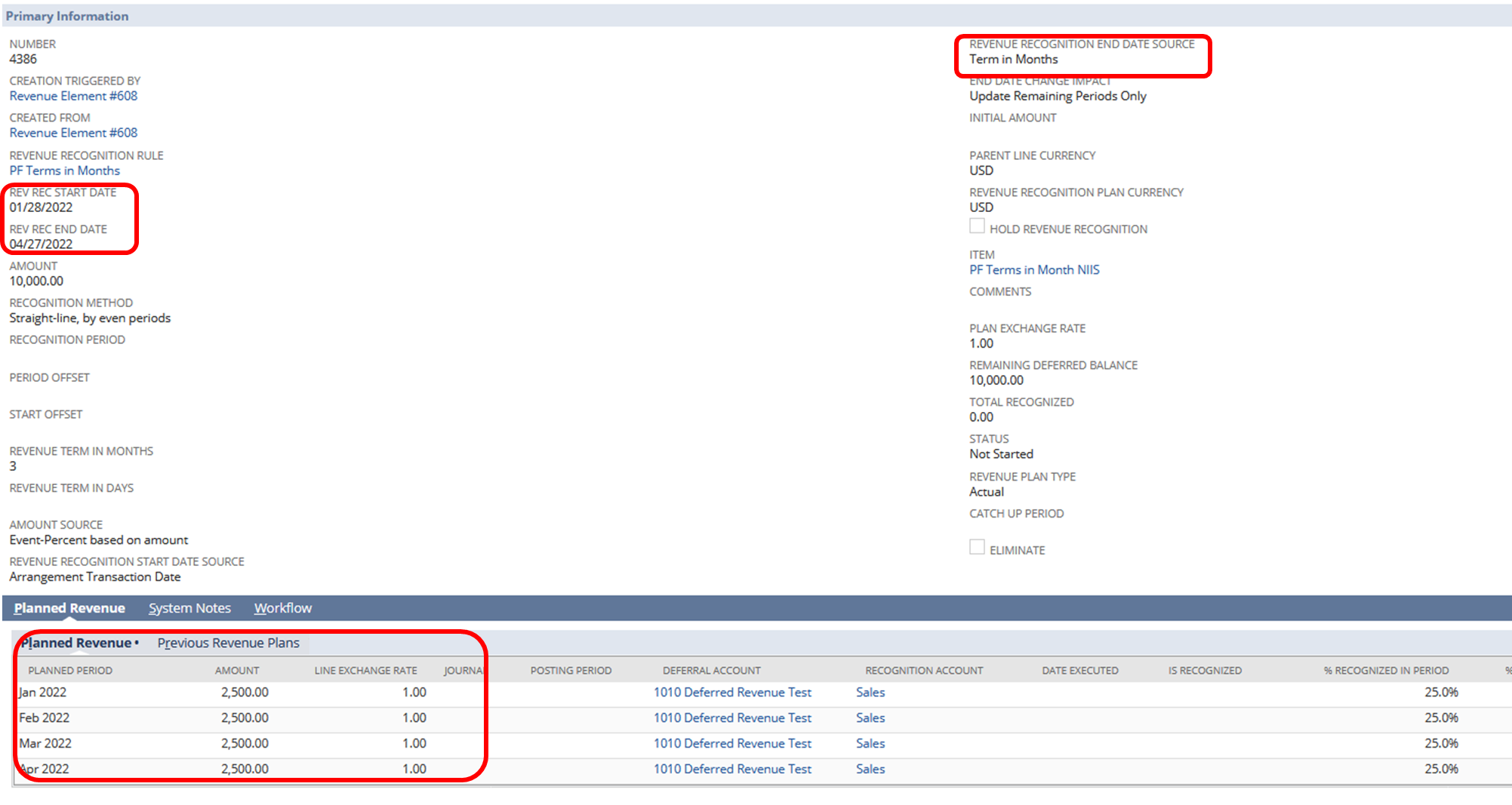

Revenue Plan:

In this scenario, revenue recognition end date depends on the month. Since the Rev Rec Start date is January 28, 2022 which counts 3 days for January (Jan 28 – 31) the end date will be April 27, 2022 for the whole month to be complete ( 27 days in April, 3 days in January).