Scenario: The Tax Code that is being pulled on Sales transactions is based on the Customer’s Shipping Address even though there is a Tax Item set on the Customer record. Tax configuration is as follows:

- Advanced Taxes is enabled.

- Enable Tax Lookup on Sales Transactions is marked.

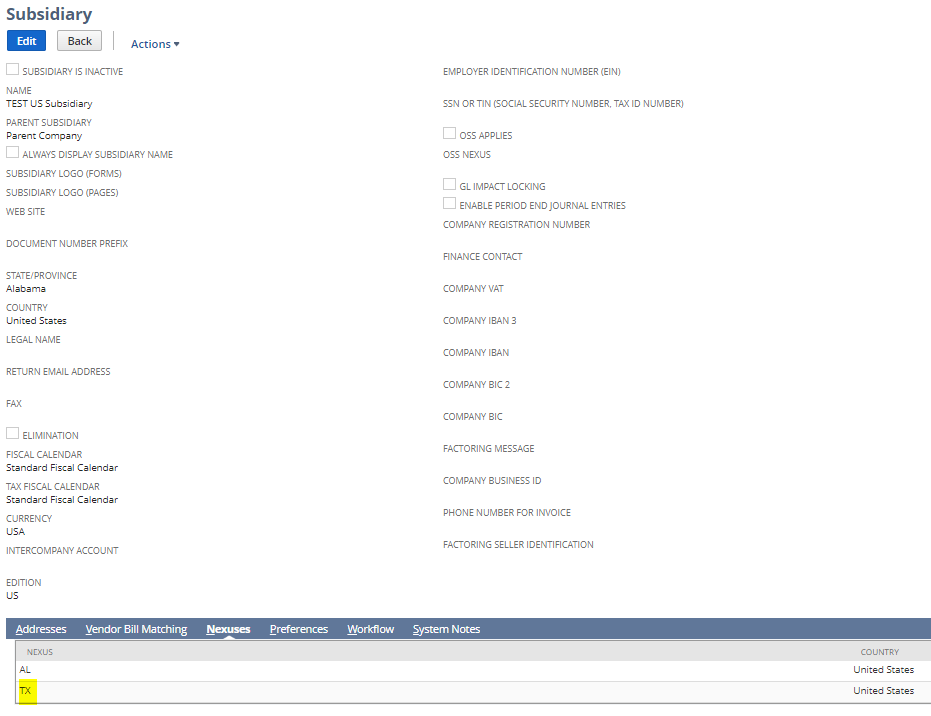

- Nexus is appropriately added to the Subsidiary record.

- All Tax Control Accounts are active.

- Tax Code Lists Include is set to Tax Groups and Tax Codes.

- Customer is marked to be Taxable and has a Tax Item set. It is associated to multiple subsidiaries.

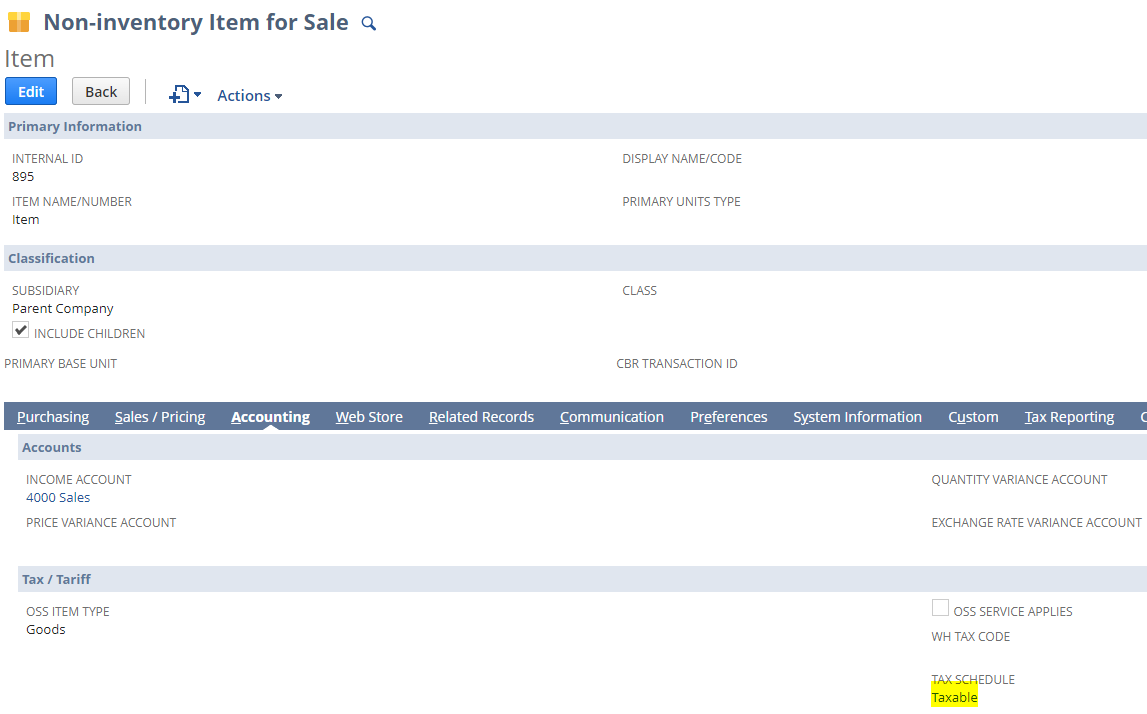

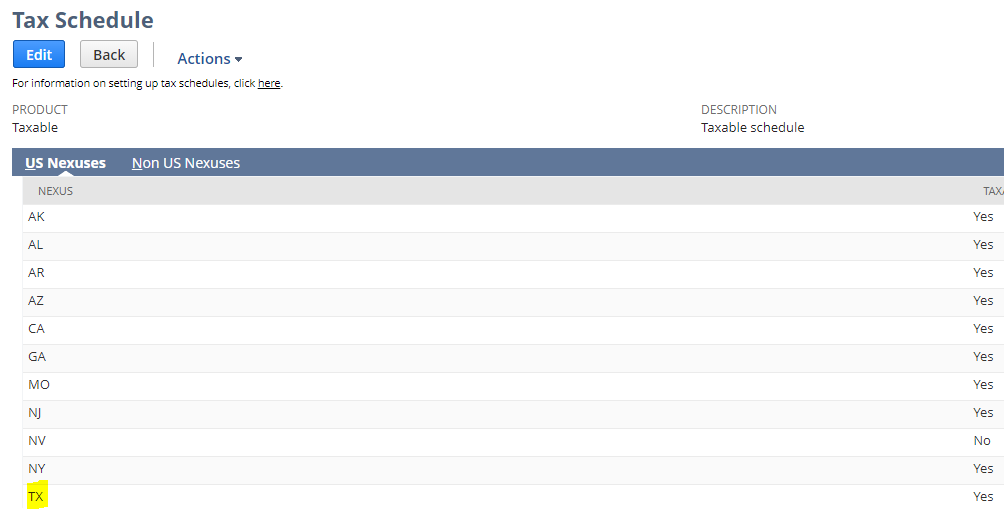

- Item has a taxable schedule on the nexus of the transaction.

Based on SuiteAnswers 86008 || U.S. Tax Lookup Hierarchy, if a Customer record has a Tax Item, then it should be the Tax Code of the transaction. The system will pull the Tax Code based on the Customer’s Shipping Address only if:

- The Customer has no Tax Item and;

- The Shipping Address is valid.

Explanation: As discussed in SuiteAnswers 70186 || Multi Subsidiary Customer Feature Limitations, “All tax information from the customer record defaults only to the primary subsidiary, and is ignored when a secondary subsidiary is selected.” With this, Tax Item will be pulled on the Sales transaction accordingly only if the Primary subsidiary is selected on it. Once a Secondary subsidiary is selected, the Tax Item will be ignored and the Tax Code will instead be based on the Customer’s Shipping Address.

An enhancement is currently logged for this limitation: Enhancement #504185 || Multi-Sub Customer > Set Tax Item on Customer Record > Tax Item is being sourced on sales transaction only for Primary Subsidiary but not for secondary subsidiaries > Support ability to source Tax Item from Customer record for secondary subsidiaries. According to the Enhancement record, the alternate solution is to set a Default Tax Item on the Tax Schedule assigned on the Item record. Another possible workaround is to manually select the Tax Code on the Sales transaction.

Illustration:

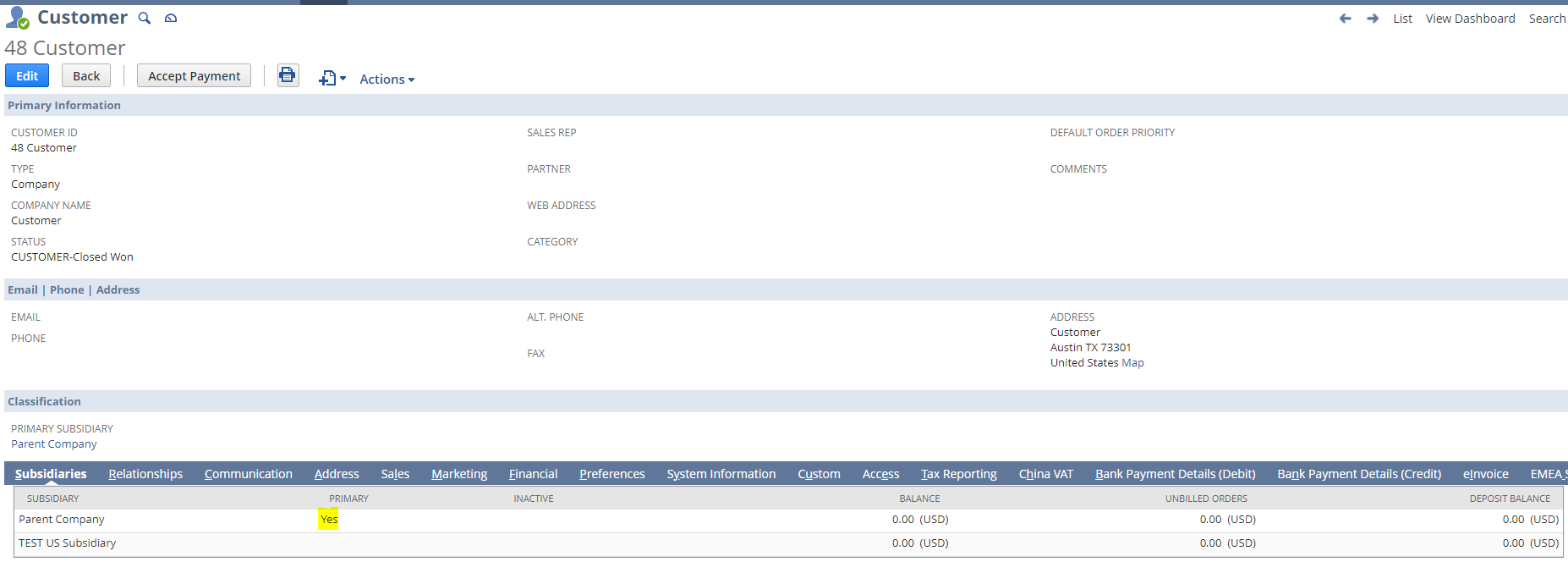

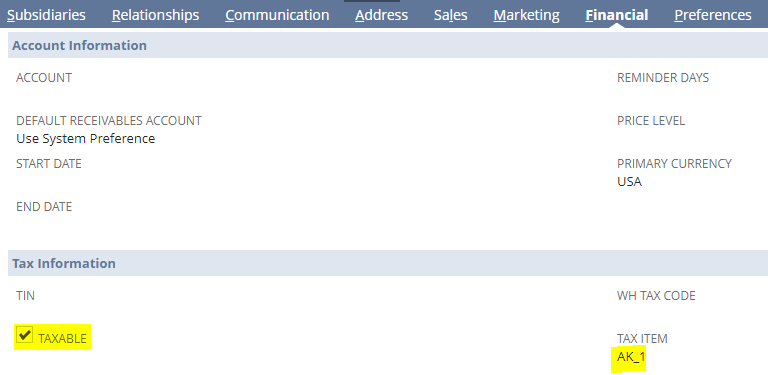

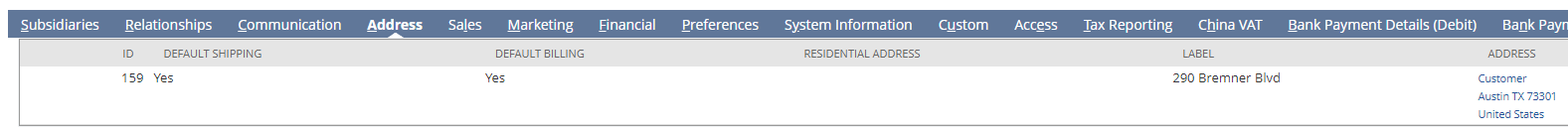

I. Customer record is associated to multiple subsidiaries–Parent Company (Primary) and TEST US Subsidiary (Secondary). It has Texas, United States as its Default Shipping Address. It is taxable and it has AK_1 as its Tax Item:

II. Item record is taxable in the transaction nexus (TX):

III. Transaction nexus is added to the Subsidiary record:

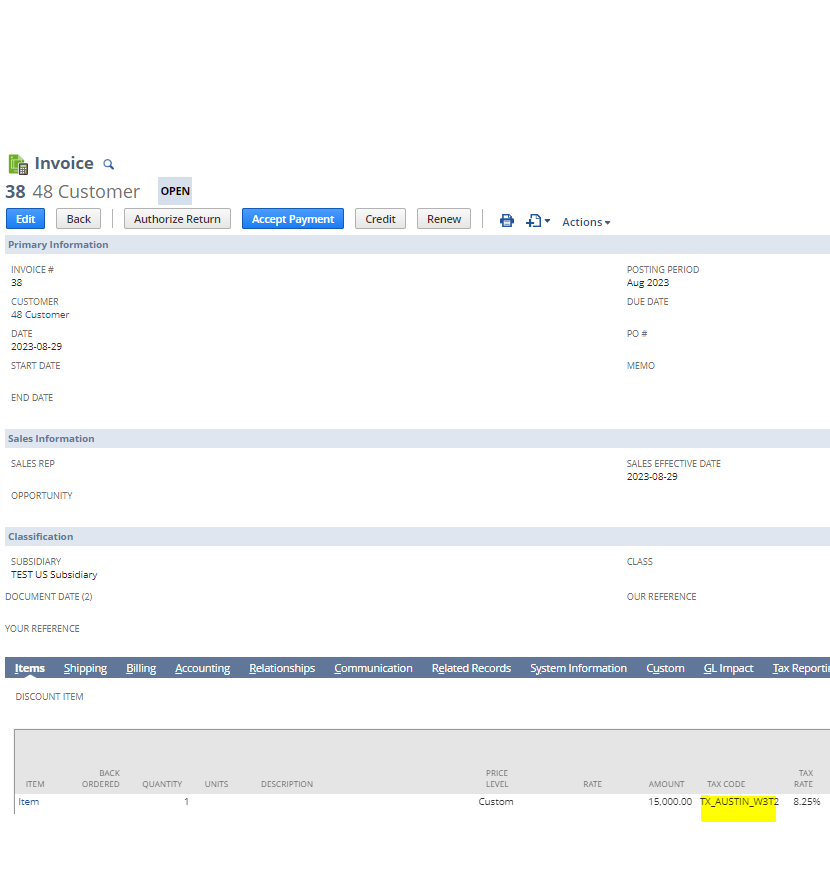

IV. Secondary subsidiary is selected on the Invoice:

Result: Tax Code is looked up based on the Customer’s Shipping Address. Tax Item is not pulled by the system as the Tax Code since the subsidiary selected on the Invoice is TEST US Subsidiary, which is the Secondary subsidiary.

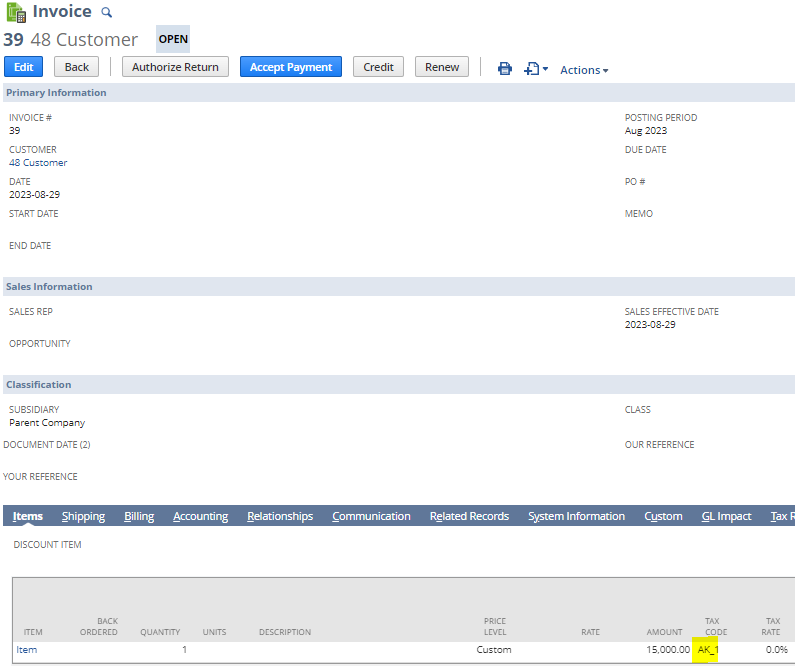

If the Primary subsidiary is selected on the Invoice (Parent Company), the system will pull the Tax Item (AK_1) as the Tax Code on the Invoice:

The above limitation is also one of the most common reasons why taxes are not calculated when a Secondary subsidiary is selected on the Sales transaction when using Avalara.