A manufacturing company may be in need to track Capitalized Interest on each asset during the build of an asset and then once the asset is built and delivered to a customer the company can then accrue interest to the cost of the asset.

NetSuite does not have a process specific to a Construction in Progress as of now. We have created the following Enhancement requests:

· 285015 Support Construction In Progress (CIP) for Fixed Assets Management

· 253818 Fixed Assets > Transactions > Please provide the ability to create Fixed Asset records that passes through Work In Process (WIP) account

However, there is a workaround that involves creating a new Asset Type and performing an Asset Transfer. Here are the steps:

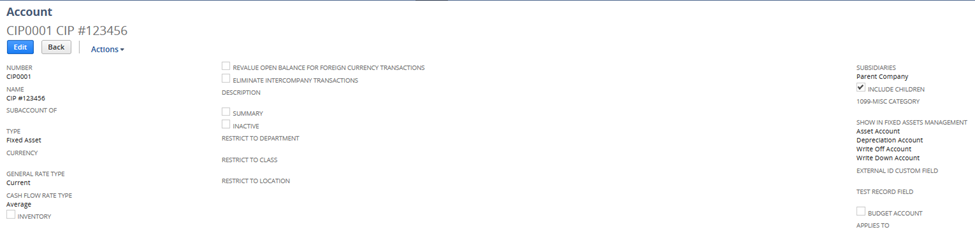

1. Create a new Asset Type and Asset Account with name Construction in Progress. For creating asset type, please visit SuiteAnswers: 105122 – Asset Types.

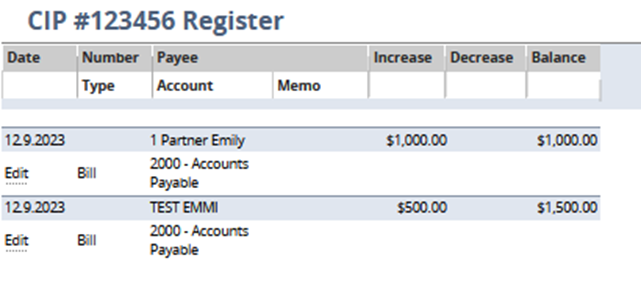

2. Record expenses related to the Asset being constructed to Construction in Progress Asset Account

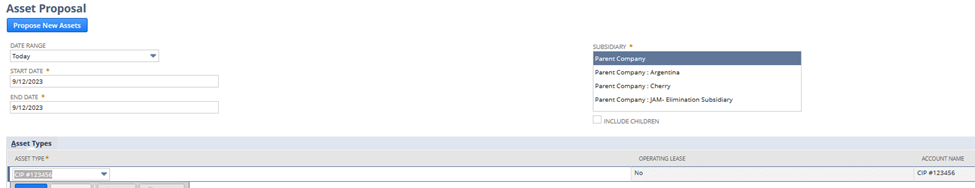

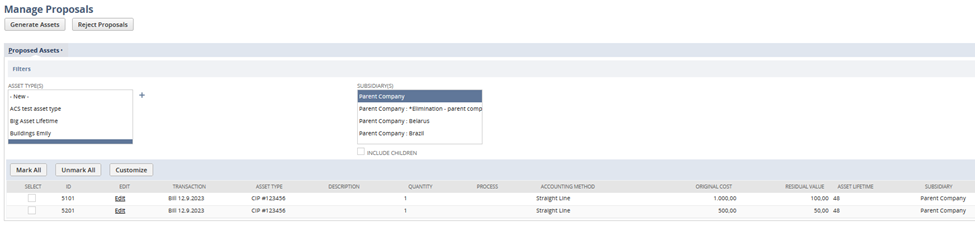

3. Once the Asset is completed, propose new asset for Construction in Progress Asset Type, select all transactions and Generate Asset. Please visit SuiteAnswers: 19273 – Asset Proposal and Generation for detailed process of Asset Proposal and Asset Generation.

Note:

A. In case you don’t want to run depreciation for these CIP Assets, you may set the following:

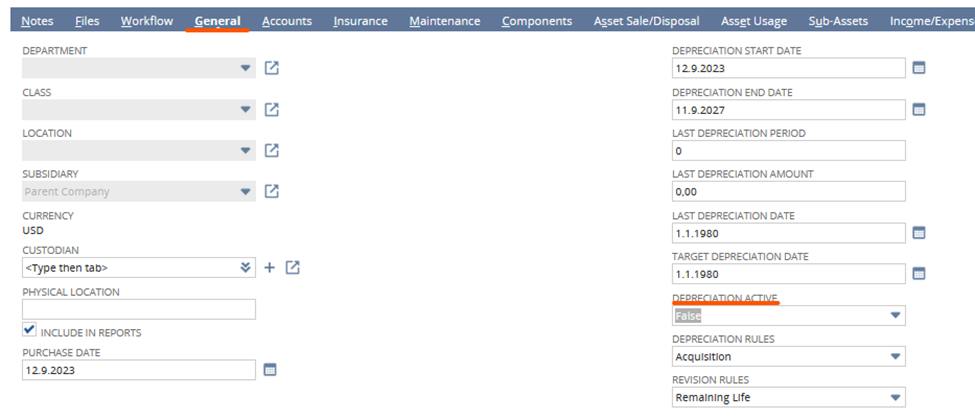

1. Click Edit on your CIP Asset

2. Navigate to General tab

3. Set Depreciation Active: False:

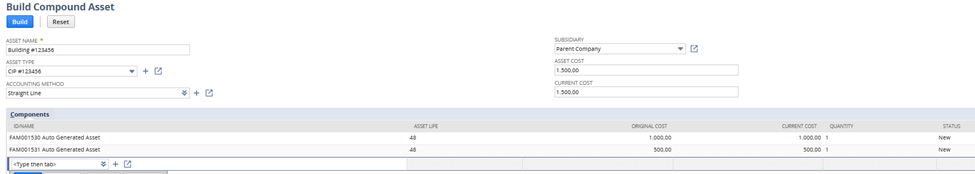

B. For each Bill checked on the ManageProposal page will be created separateAsset. In case you would like to have them linked together, you may use the FAM functionality of the Compound Assets (SA: 62835 – Build Compound Assets).

4. Once the asset is fully created, you may then perform Asset Transfer from Construction in Progress Asset Type to the correct Asset Type. For detailed Asset Transfer instruction, please visit SuiteAnswers: 27189 – Asset Transfer.

Note: All the accounting settings above are just illustrative and needs to be discussed with your inhouse accountant department.