As documented in SuiteAnswers 49235, Calculated Fair Value Amount is the fair value price for the item from the Fair Value Price List. This amount is used to calculate the final allocation amounts. Should there be no Fair Value Price List assigned to the item and Use Sales Price as Fair Value Preference is enabled in Setup > Accounting > Accounting > Preferences > General under Advanced Revenue Management Only, the system will use the Sales Amount as the basis of the Calculated Fair Value Amount. Therefore, it will also be the basis of the Revenue Allocation Ratio for the determination of the Revenue Amounts.

To use the Discounted Sales Amount as the Basis of the Revenue Allocation ratio instead of the Sales Amount, users may do either of the following:

- Mark the Fair Value Override box on the Revenue Arrangement to manually update the Calculated Fair Value Amounts (SuiteAnswers 65822)

- Create a Fair Value Price List to set the Discounted Sales Amount in the Fair Value Formula (SuiteAnswers 49181 and 49179)

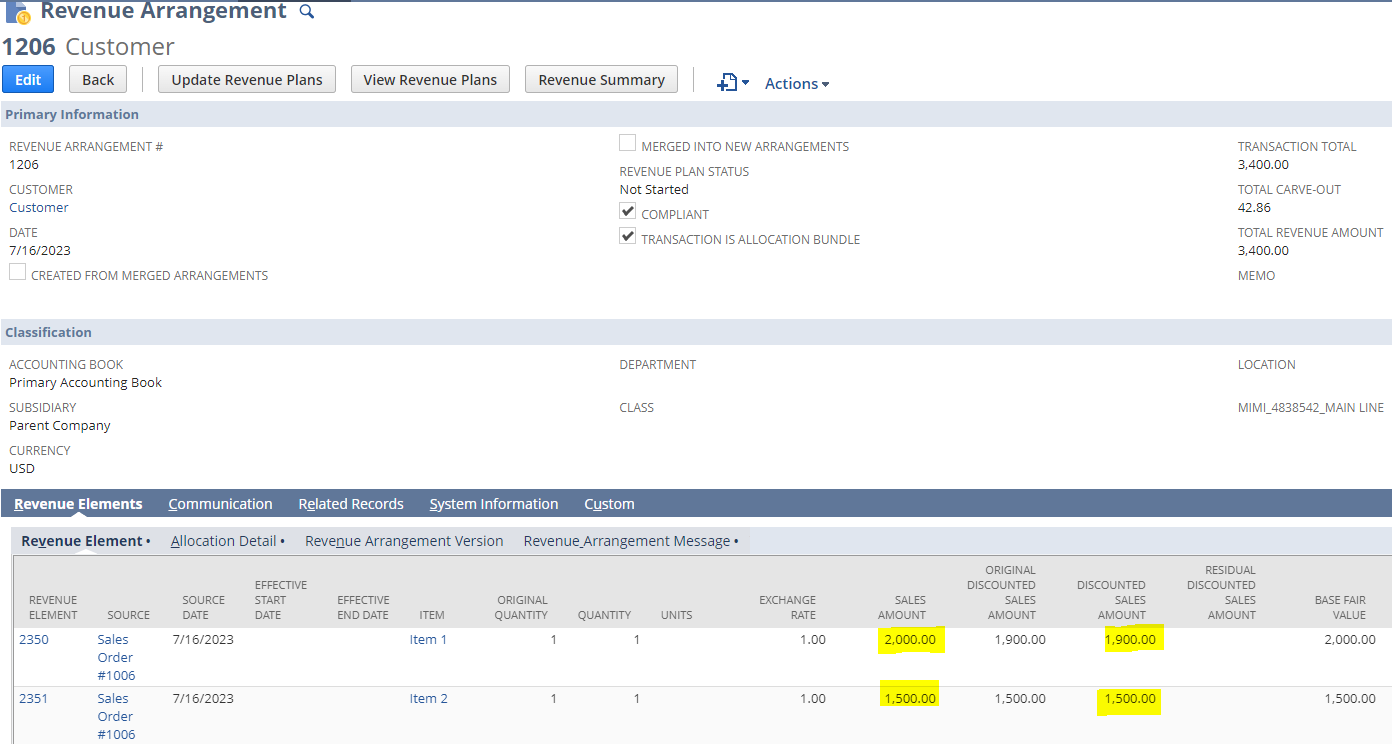

Scenario: A Multi-Element Revenue Arrangement is created from a Sales Order. The Sales Amount is different from the Discounted Sales Amount as a Discount rate of 5% is applied to the first item. Use Sales Price as Fair Value Preference is enabled in Setup > Accounting > Accounting > Preferences > General under Advanced Revenue Management Only and there is no Fair Value Price List assigned on the items. Hence, the system used the Sales Amount as the basis of the Calculated Fair Value Amount and therefore, the Revenue Allocation Ratio.

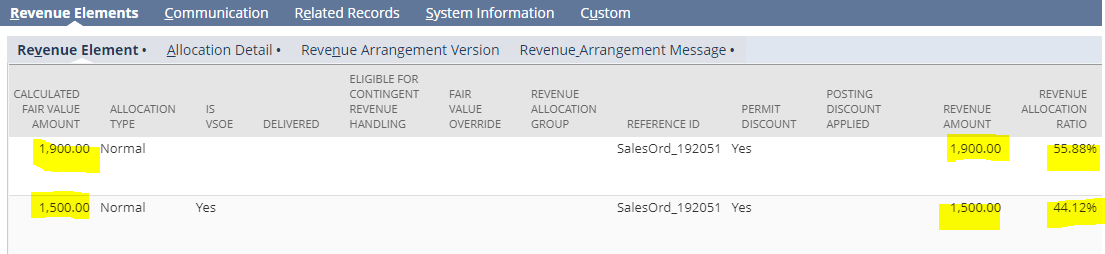

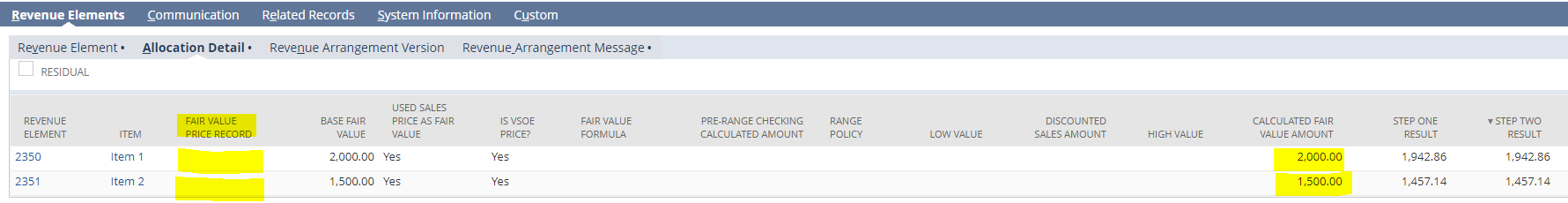

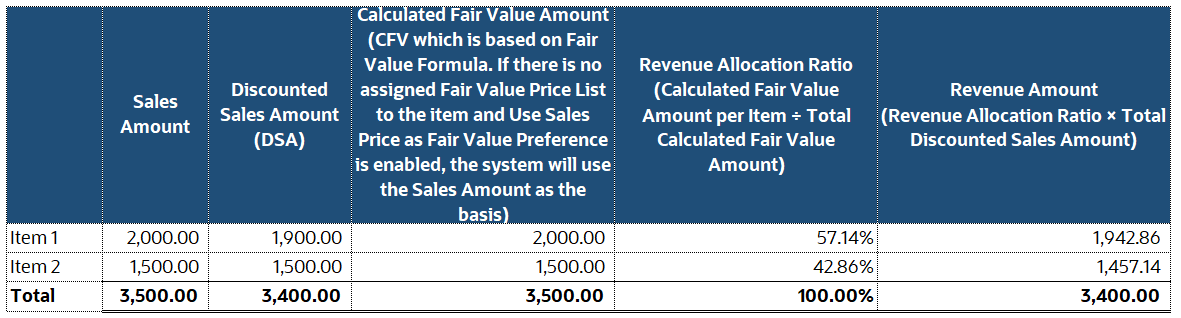

On the below snippet (Revenue Elements sub-tab > Allocation Detail), you will notice that there is no linked Fair Value Price Records on the items. Accordingly, Calculated Fair Value Amounts are just the same with the Sales Amounts.

Below is an excel table showing how the Revenue Amounts are computed using the Sales Amount as the basis of the Revenue Allocation Ratio:

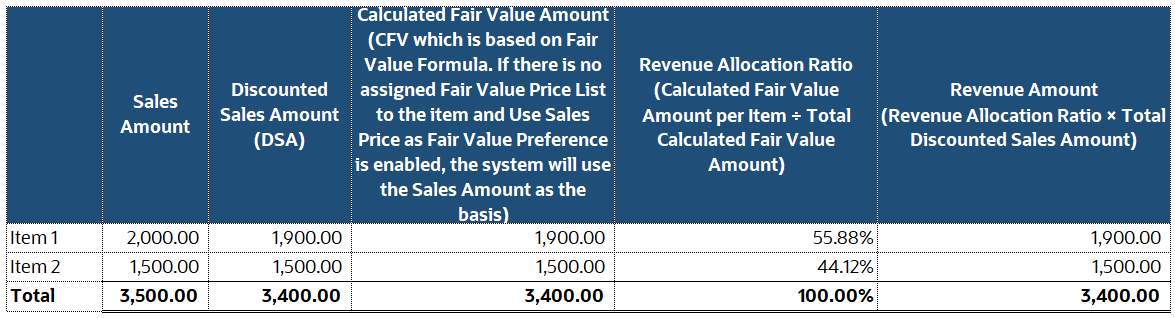

Users expect for the Revenue Amounts to be based on the Discounted Sales Amounts just like in the table below:

As stated above, there could be two workarounds for this scenario:

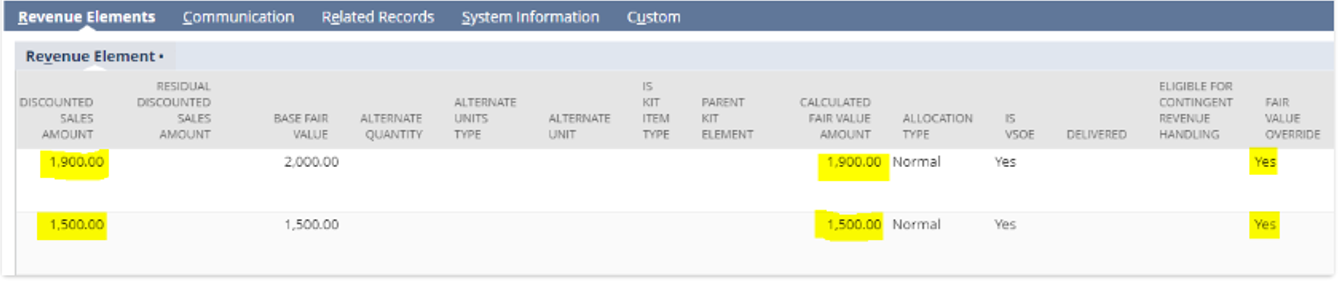

OPTION 1: Mark the Fair Value Override box on the Revenue Arrangement to manually update the Calculated Fair Value Amounts

- Edit the Revenue Arrangement.

- Check the Fair Value Override box for each element whose allocation you want to change.

- Make the changes you want to the Calculated Fair Value Amount.

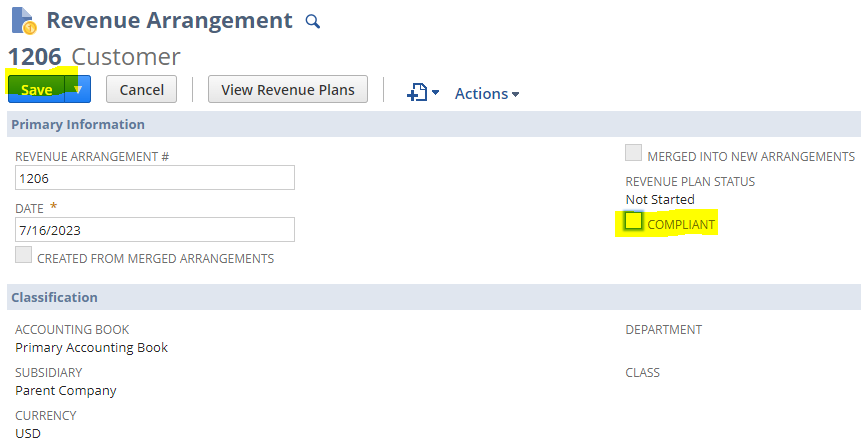

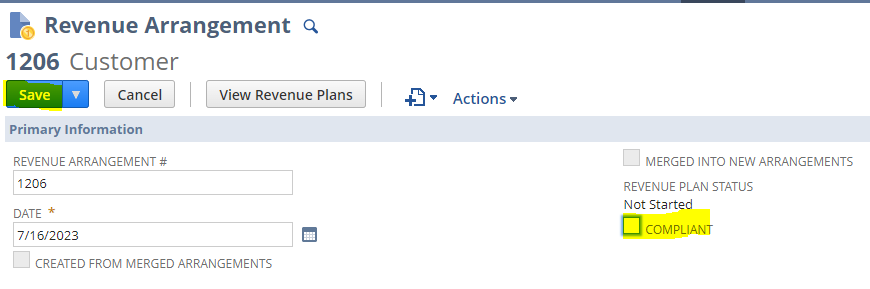

- Clear the Compliant box and save the arrangement.

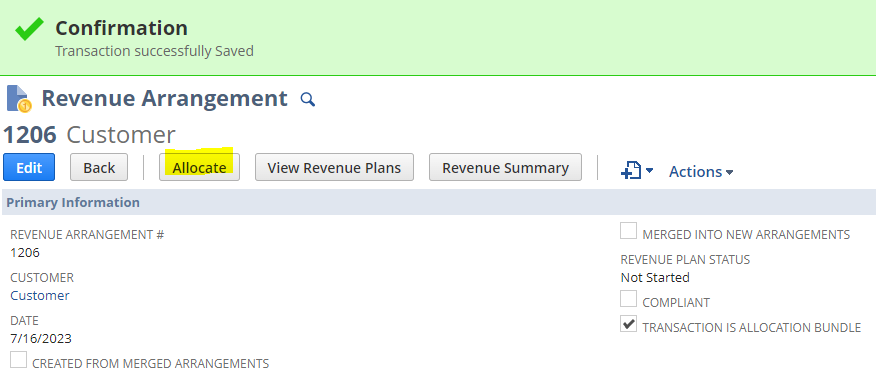

- Click Allocate button.

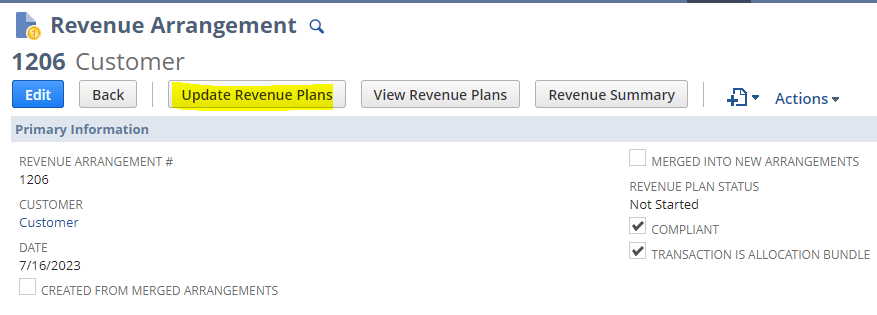

- Click Update Revenue Plans button.

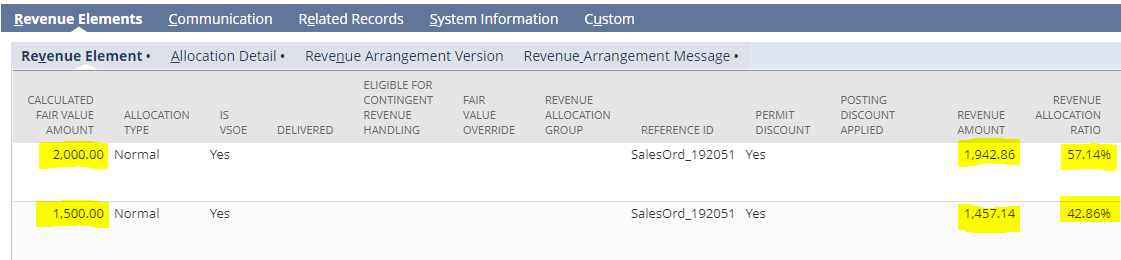

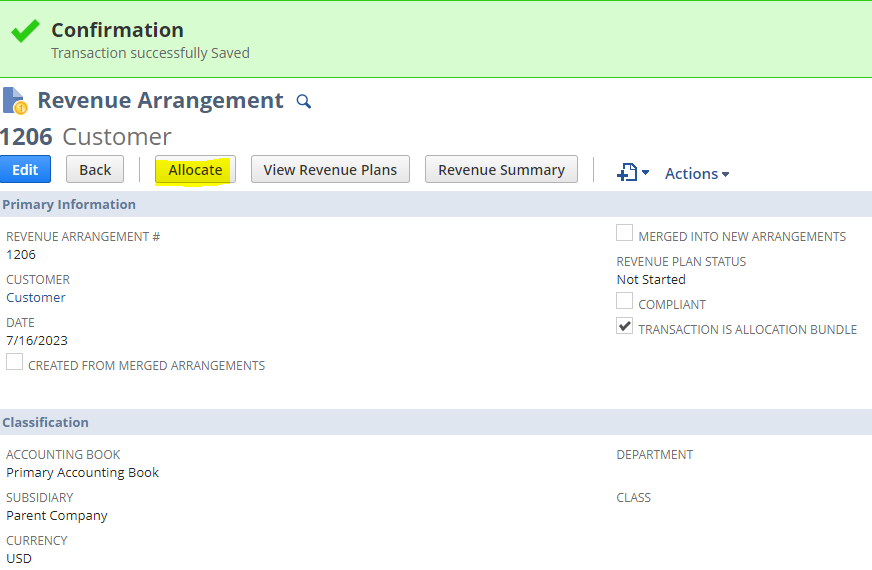

After doing the above steps, Revenue Allocation is now as follows:

OPTION 2: Create a Fair Value Price List to set the Discounted Sales Amount in the Fair Value Formula

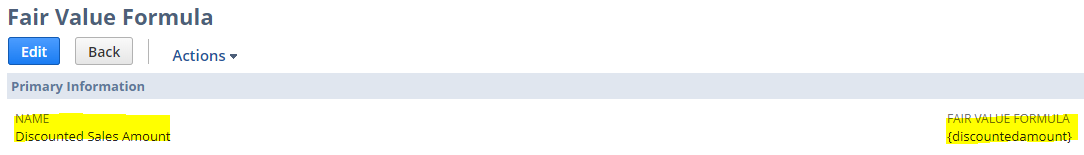

- Create a Fair Value Formula via Setup > Accounting > Fair Value Formulas > New.

- Populate the fields as follows:

- Fair Value Formula field = {discountedamount}

- Name = (any name applicable)

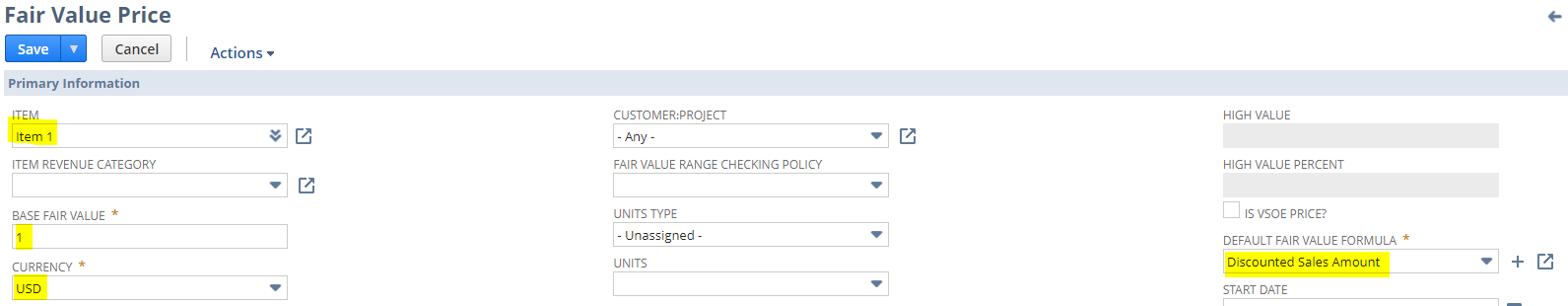

- Create a Fair Value Price List via Setup > Accounting > Fair Value Price Lists > New.

- Populate the fields as follows:

- Item = Item that you would want to re-allocate using the Discounted Sales Amount

- Base Fair Value = Base fair value for a unit of the item

- Currency = Transaction Currency

- Default Fair Value Formula = Formula created in Step #1 above

- Click Save button.

- Click Edit on the existing Revenue Arrangement.

- Note: In this scenario, it is as if Option 1 has not been applied to the existing Revenue Arrangement yet.

- Unmark Compliant checkbox.

- Click Save button.

- Click Allocate button.

- Click Update Revenue Plans button.

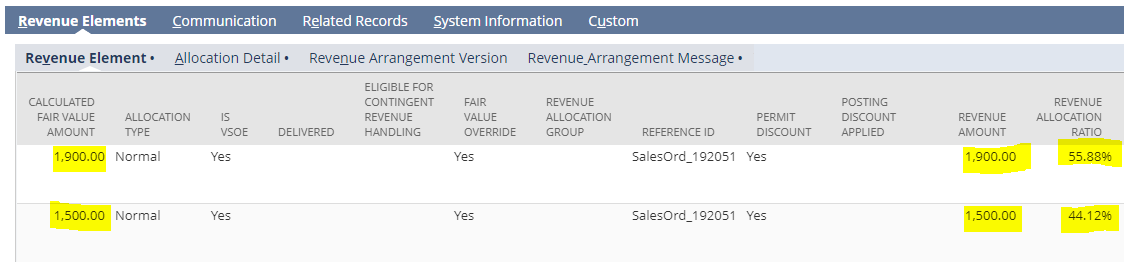

After doing the above steps, Revenue Allocation is now as follows: