Nonprofit organizations seek funding through a variety of channels; donations from philanthropic individuals and organizations and fundraising events quickly come to mind. Another way nonprofits can obtain financial support for their initiatives is by receiving grants.

What Is Grant Management?

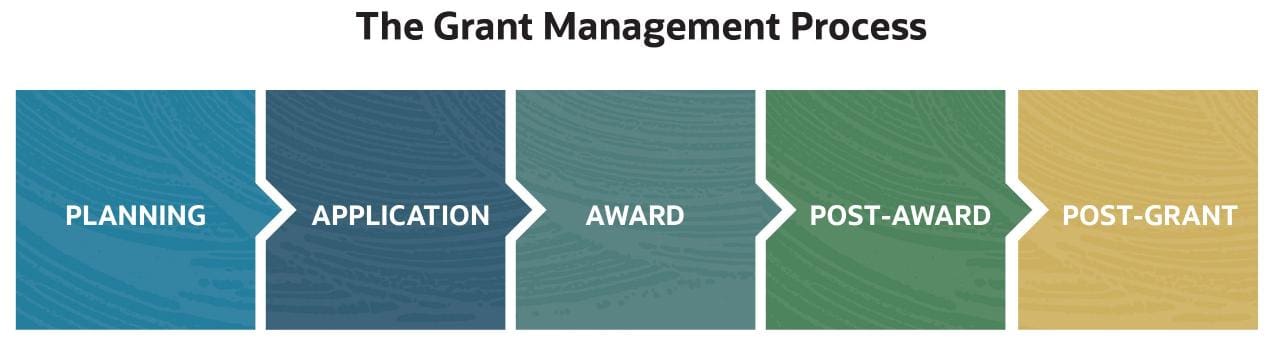

Grant management refers to the oversight of all phases of the grant life cycle, from a nonprofit finding a suitable grant and completing a proposal to receiving an award, carrying out its specific requirements, reporting results and closing out the grant process. Suffice it to say, effective grant management necessitates clear communication both within the nonprofit (the grantee) and externally with the granting agency (the grantor or funder).

Key Takeaways

- Grant management is the process of overseeing and completing the pre-award, award and post-grant phases of the nonprofit grant cycle.

- Grant management involves researching opportunities, generating proposals, tracking project milestones and recording the financial transactions that support the detailed reporting required by grant makers.

- Following grant management best practices helps nonprofits avoid common mistakes during the grant cycle.

Importance of Grant Management

Grants are one type of financial support that nonprofits rely on, to varying degrees, to fund and accomplish their goals. (Other forms of support include charitable donations, volunteer staff and provisions, and sales from nonprofit-sponsored gift shops and programs.) A major metropolitan opera, for example, might rely on several small grants for its student programs, whereas a local trails group will more likely depend on a state transportation grant. But no matter the amount of the grant awarded or the size of the nonprofit on the receiving end, grant management is key to the successful execution of a grant.

Grant management begins the moment the nonprofit decides to pursue a grant. Steps include writing the grant proposal, communicating with the granting agency throughout the grant’s execution and meticulous financial recordkeeping. The latter not only helps with a funder’s reporting requirements, but it also helps the nonprofit stay in compliance with the grant’s guidelines. Failure to do so could delay project reimbursements or jeopardize future funding opportunities.